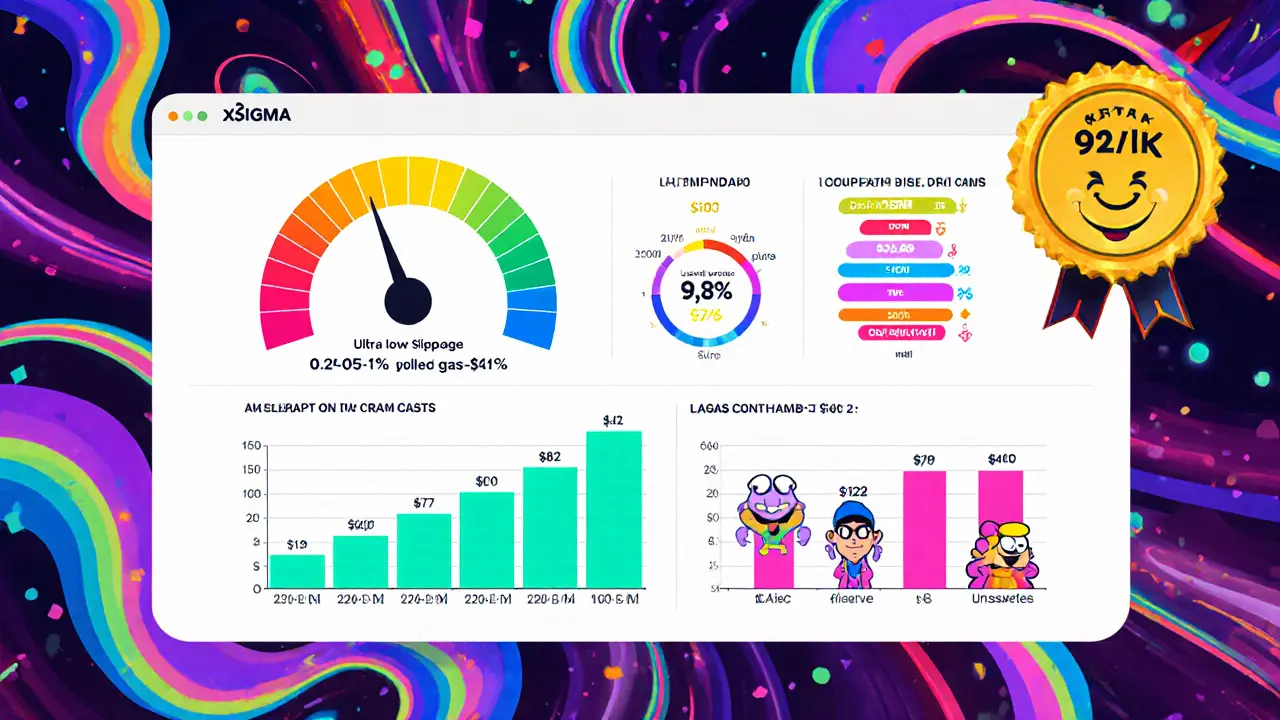

xSigma Fee Savings Calculator

Calculate Your Savings

See how much you save on fees when using xSigma DEX versus Curve or Uniswap for stablecoin swaps

Enter an amount to see fee comparisons

xSigma DEX is a decentralized exchange built exclusively for stablecoins. Launched in Q4 2023, it promises ultra‑low slippage and gas‑optimized swaps across multiple L2s. This xSigma DEX review walks you through how the platform works, its real‑world numbers, and whether it’s worth your capital.

How xSigma DEX Works

The core of xSigma’s tech stack is a hybrid AMM that blends on‑chain settlement with off‑chain order‑book matching for large trades. When you initiate a swap, the router first checks a concentrated‑liquidity layer for the best price range, then routes the order across Ethereum, Arbitrum and Polygon to tap into the deepest pools. The three‑layer model-concentrated ranges, cross‑chain routing, and the proprietary “Sigma Stable Pool”-keeps the constant‑product formula but dynamically tweaks fees based on volatility.

Because the final settlement is still on‑chain, you retain full custody of your assets. The platform integrates with MetaMask, WalletConnect and Ledger, meaning you never hand over private keys to a custodian. For institutions, an upcoming API (scheduled for Q4 2025) will expose the same routing logic without a UI.

Performance Numbers You Care About

As of Q2 2025, xSigma processes roughly $87 million in daily volume across 15 stablecoin pairs, according to DeFiLlama. The most eye‑catching metric is slippage: $100 000 swaps between USDC and USDT typically see 0.02‑0.05 % price impact. By comparison, Curve Finance runs 0.15‑0.25 % and Uniswap sits around 0.3‑0.5 % for similar trades. The platform also trims gas costs to an average of $0.85 per transaction on Ethereum mainnet, a 35‑45 % saving versus the $1.50‑$2.50 range seen on generic DEXs.

Daily active users hover around 12 450 on Discord, and the platform’s TVL hit $412 million in September 2025, placing it 14th among all DEXs. While that’s modest next to Uniswap’s $3.2 billion, the growth rate-285 % YoY-outpaces the 142 % average for the top‑10 DEXs.

Pros and Cons

- Pros

- Industry‑leading slippage for stablecoin swaps (0.02‑0.05 %).

- Gas‑optimised batch settlement reduces costs by up to 45 %.

- No KYC needed for trades up to $500 000.

- Native $SIGMA token offers up to 50 % fee discounts for stakers.

- CertiK audit score of 92/100, strong multi‑sig treasury.

- Cons

- Only stablecoins - no volatile assets, limiting diversification.

- Cross‑chain routing occasionally stalls during extreme gas spikes.

- Community size smaller than Curve or Uniswap, which can affect liquidity depth on newer pairs.

xSigma vs Other Stablecoin DEXs

| Metric | xSigma DEX | Curve Finance | Uniswap (stable pairs) |

|---|---|---|---|

| Average slippage (100k swap) | 0.02‑0.05 % | 0.15‑0.25 % | 0.30‑0.50 % |

| Gas cost (USD) | 0.85 | 1.45 | 1.80 |

| Daily volume (M USD) | 87 | 220 | 310 |

| TVL (USD) | 412 M | 2.1 B | 3.2 B |

| Supported networks | Ethereum, Arbitrum, Polygon (expanding to Base, Optimism) | Ethereum, Optimism, Arbitrum, Polygon | Ethereum, multiple L2s |

Numbers come from DeFiLlama, CryptoPotato and the respective platform dashboards (Oct 2025). The table shows why xSigma shines for pure stablecoin swaps: slippage and gas are dramatically lower, even if overall volume and TVL lag behind the giants.

Using xSigma: Step‑by‑Step Guide

- Connect your wallet (MetaMask, WalletConnect, or Ledger) via the “Connect” button.

- Select the stablecoins you want to trade. The UI automatically highlights the pair with the best routing.

- Set a custom slippage tolerance (default 0.05 %). Most users keep it at the default because the engine already optimises routes.

- Enter the amount (minimum $100, maximum $500 000 per transaction). Review the estimated gas fee-usually under $1 on Ethereum.

- Click “Swap.” The transaction is first signed off‑chain, then settled on‑chain in a batched batch. You’ll see a confirmation once the block is finalised.

- Optional: Stake $SIGMA for fee discounts. Navigate to the “Staking” tab, approve the token, and lock the desired amount. Discounts apply instantly to subsequent swaps.

Typical onboarding takes under three minutes, and most users feel comfortable after 3‑5 swaps. The platform’s knowledge base flags two common hiccups: “approval limit” errors (fix by resetting allowance) and “route failure” during gas spikes (retry automatically or switch to a lower‑gas L2).

Tokenomics of $SIGMA

$SIGMA is the native governance token powering fee rebates, liquidity mining and voting rights.

- Circulating supply: 142.5 M (Oct 2025).

- Staking APR: 3.5‑8.2 % depending on pool and network.

- Fee discounts: 10 % for 1 % stake, scaling to 50 % at 10 % stake.

- Governance: Token holders can propose fee‑structure changes, liquidity‑layer parameters, and the upcoming quadratic‑voting upgrade slated for Q1 2026.

Market analysts value $SIGMA at about 8.2 × forward revenue, which is lower than Curve’s 12.7 ×, suggesting upside if the platform keeps growing its TVL.

Future Outlook

xSigma’s roadmap shows aggressive expansion. v2.4 (Oct 2025) added native EIP‑4844 support, shaving another 22‑35 % off gas for roll‑up users. By Q4 2025 the exchange will launch an institutional API, enabling banks and payment processors to route treasury swaps automatically.

Regulatory headwinds could be a factor. The platform’s exclusive focus on audited, reserve‑backed stablecoins aligns it with the EU’s MiCA framework, but U.S. definitions remain fuzzy, which may affect onboarding of U.S. institutional users.

Messari projects a 68 % chance of cracking the top‑5 stablecoin‑DEX spot by mid‑2026, provided the team can broaden its token list to 20+ stablecoins and resolve occasional cross‑chain routing glitches.

Quick Checklist Before You Trade

- Verify you’re on the official xSigma site (check SSL and contract addresses).

- Have a compatible non‑custodial wallet ready.

- Confirm the stablecoin pairs you need are supported (USDC, USDT, DAI, FRAX, GHO, LUSD, etc.).

- Set slippage tolerance to 0.05 % unless you have a specific reason to loosen.

- If you trade large volumes, consider staking $SIGMA for fee discounts.

- Monitor network congestion; switch to Arbitrum or Polygon for cheaper gas during spikes.

Is xSigma DEX safe for large stablecoin swaps?

Yes. The platform uses on‑chain settlement with a CertiK audit score of 92/100. Large swaps are routed through off‑chain order‑book matching to avoid price impact, then settled on‑chain, keeping funds under your control.

How does the slippage on xSigma compare to Curve?

For a $100 000 USDC→USDT trade, xSigma delivers 0.02‑0.05 % slippage, while Curve typically shows 0.15‑0.25 % - roughly a 67 % reduction.

Can I use xSigma without KYC?

Yes. Trades up to $500 000 can be executed without any identity verification, thanks to the non‑custodial design.

What are the fee discounts for staking $SIGMA?

Stakers receive a fee rebate that scales from 10 % at a 1 % stake up to 50 % when holding 10 % of the circulating supply.

Will xSigma support volatile assets in the future?

The roadmap focuses on stablecoins for now. Management has hinted at possible expansions, but no official timeline exists yet.

Write a comment