DYCO Buy-Back Simulator

How DYCO Works

With DYCO, if a project fails to meet milestones, DAO Maker automatically buys back your tokens at the original price. See how much you could recover.

Protection Analysis

DYCO Advantage Your protection is calculated based on the buy-back guarantee mechanism.

With DYCO, you'd get back $0.00 instead of losing $0.00 if the project fails.

DAO Maker isn’t just another crypto coin. It’s a platform built to fix one of the biggest problems in crypto: how startups raise money without screwing over investors. Launched in 2018, DAO Maker acts like a decentralized venture capital firm, but instead of rich backers making decisions, the community does - using its native token, DAO.

What Does DAO Maker Actually Do?

Think of DAO Maker as a launchpad for new blockchain projects. It helps startups raise funds through structured, fair, and safer methods than old-school ICOs. The platform doesn’t just list tokens and hope for the best. It gives investors tools to protect themselves - and rewards people who help grow the ecosystem.

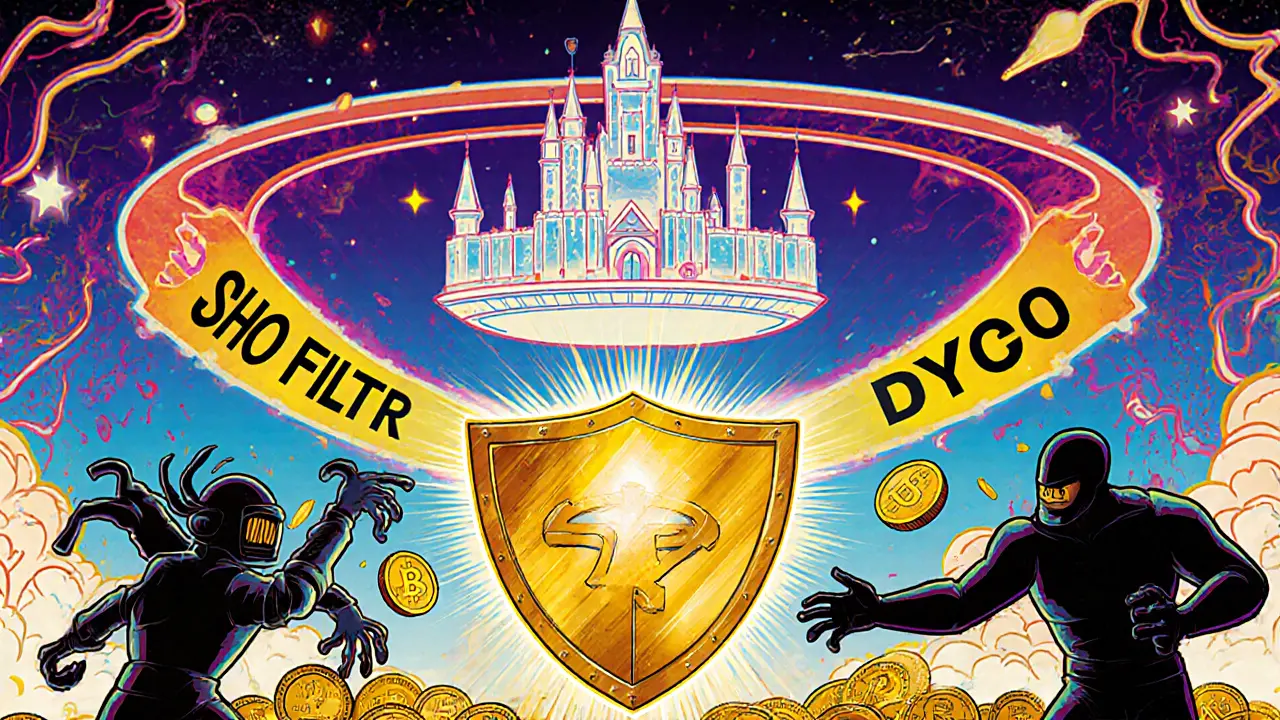

Three core systems make this work: Social Mining, DYCO, and SHOs.

- Social Mining rewards users with DAO tokens for helping new projects grow - whether that’s sharing news, writing reviews, or bringing in new users. It turns passive holders into active participants.

- DYCO (Dynamic Coin Offering) is the standout feature. Unlike regular token sales where you buy and hope the project doesn’t fail, DYCO includes a built-in buy-back guarantee. If a project doesn’t hit its milestones, DAO Maker automatically buys back tokens from investors at the original price. That means your money isn’t just gone if things go sideways.

- SHOs (Selective Hard Offerings) are invite-only token sales for people who’ve proven they’re serious. You need to pass KYC and have a track record of supporting projects. This keeps out short-term speculators and bots, giving real supporters a better shot at early access.

What Is the DAO Token?

The DAO token is the engine behind all this. It’s an ERC-20 token built on Ethereum, so it works with any wallet that supports Ethereum - MetaMask, Trust Wallet, Coinbase Wallet, you name it.

Here’s what you can do with DAO tokens:

- Participate in SHOs and DYCOs

- Earn rewards through Social Mining

- Vote on platform upgrades and new project listings

- Stake to earn more DAO or access premium features

It’s not a currency like Bitcoin. It’s a utility and governance token. You don’t hold it just to speculate - you hold it to get involved.

Current Market Status (November 2025)

DAO Maker’s price has been through the wringer. Its all-time high was $8.75 in 2021. As of now, it trades between $0.07 and $0.14 - a drop of over 98% from its peak.

Market cap hovers around $15-26 million, depending on the source. That puts it around #900-920 on CoinMarketCap, which means it’s a small player compared to top coins like Bitcoin or Ethereum. Trading volume is low - between $800K and $1.7 million in 24 hours - meaning it’s easy for prices to swing up or down with just a few big trades.

Over the last 30 days, the price has dropped around 30%. The Fear & Greed Index for DAO Maker sits at 42 - in the “Fear” zone. That tells you most traders are cautious, if not outright worried.

But here’s the twist: some analysts see this as a buying opportunity. The token’s fundamentals - the DYCO system, active community tools, and real project pipeline - haven’t disappeared. The market just hasn’t caught up yet.

How DAO Maker Compares to Other Launchpads

There are dozens of crypto launchpads: Binance Launchpad, Polkastarter, Seedify, and more. So why pick DAO Maker?

Most launchpads just list tokens. DAO Maker adds risk protection. DYCO’s buy-back guarantee is rare. No other major platform offers that kind of investor safety. Even if a project flops, you don’t lose everything.

SHOs are also unique. Other platforms let anyone jump in during a token sale - which leads to bots sniping all the allocations. DAO Maker filters for real people. That means if you get into a SHO, you’re more likely to actually hold the token long-term instead of flipping it immediately.

On the downside, DAO Maker doesn’t have the brand power of Binance or the liquidity of bigger platforms. Its token price is volatile, and it doesn’t get much attention from mainstream crypto media. That makes it a niche pick - not a mainstream bet.

Who Is DAO Maker For?

DAO Maker isn’t for everyone.

Good fit:

- You’re into early-stage crypto projects and want some protection

- You’re willing to engage with the community - not just buy and hold

- You understand that low market cap coins are risky, but you believe in the model

- You’re looking for a way to earn tokens by helping projects grow, not just trading

Not a good fit:

- You want quick, guaranteed returns

- You’re uncomfortable with high volatility

- You don’t want to do any work beyond buying and waiting

- You’re looking for a “blue-chip” crypto with massive adoption

Can You Trust DAO Maker?

The platform has been around since 2018 and has helped launch dozens of projects. It’s listed on Coinbase, one of the most trusted exchanges. That adds credibility.

The DYCO system is powered by smart contracts on Ethereum - so the buy-back rules are automated and transparent. No one can change them after the fact.

But trust isn’t just about tech. It’s about results. Some projects that launched through DAO Maker have succeeded. Others have faded. That’s normal in crypto. The difference is, with DYCO, you’re not left with zero if a project fails.

There’s no guarantee DAO Maker will bounce back to $1 or $5. But the system itself is designed to be more resilient than most.

How to Get Started

If you want to try DAO Maker, here’s how:

- Get an Ethereum-compatible wallet (MetaMask is easiest)

- Buy ETH and swap it for DAO tokens on a supported exchange (Coinbase, KuCoin, or Gate.io)

- Connect your wallet to daomaker.com (no login needed)

- Join Social Mining by completing tasks like sharing project links or writing feedback

- Watch for upcoming SHOs - you’ll need to complete KYC to qualify

Don’t rush into a SHO. Read the project’s whitepaper. Check the team. Look at their roadmap. DAO Maker gives you tools to reduce risk - but it doesn’t eliminate it.

Final Thoughts

DAO Maker isn’t a get-rich-quick coin. It’s a tool for people who want to be part of the early-stage crypto ecosystem - but don’t want to be taken advantage of.

The token’s price is low, and the market is cold. But the platform’s core idea - protecting investors while rewarding community builders - still makes sense. If crypto launchpads are going to evolve beyond hype and scams, models like DYCO and SHOs are the way forward.

DAO Maker might not be the next Bitcoin. But if you believe in fairer, more responsible crypto fundraising, it’s one of the few platforms actually trying to make that happen.

Is DAO Maker a good investment in 2025?

There’s no simple yes or no. DAO Maker’s token price is down over 98% from its peak, and trading volume is low, which makes it risky. But its DYCO system offers unique investor protection not found on most launchpads. If you believe in long-term crypto adoption and want to support fair fundraising models, it could be worth a small position. Don’t invest more than you can afford to lose.

How do I buy DAO Maker (DAO) tokens?

Buy DAO tokens on exchanges like Coinbase, KuCoin, or Gate.io. You’ll need to first buy ETH or USDT, then swap it for DAO. Once you have DAO, you can store it in any Ethereum wallet like MetaMask or Trust Wallet. Never send DAO to a wallet that doesn’t support ERC-20 tokens.

What’s the difference between DAO Maker and a regular ICO?

Regular ICOs are one-way sales: you send money, get tokens, and hope the project succeeds. DAO Maker uses DYCO - a smart contract that automatically buys back tokens if the project misses its targets. This means you can get your money back if things go wrong, which reduces your risk significantly.

Can I earn DAO tokens for free?

Yes, through Social Mining. By helping new projects grow - like sharing updates, writing reviews, or inviting others - you earn DAO tokens as rewards. It’s not passive income; you have to actively contribute. But it’s a real way to earn tokens without spending money.

Why is DAO Maker’s price so low compared to its all-time high?

The crypto market crashed after the 2021 bull run, and low-cap tokens like DAO Maker were hit hardest. Many investors who bought near the $8.75 peak are still underwater. The platform hasn’t lost its core features, but it hasn’t gained enough mainstream attention or new users to push the price back up. Market sentiment is still cautious, and trading volume remains too low to drive strong price movement.

Write a comment