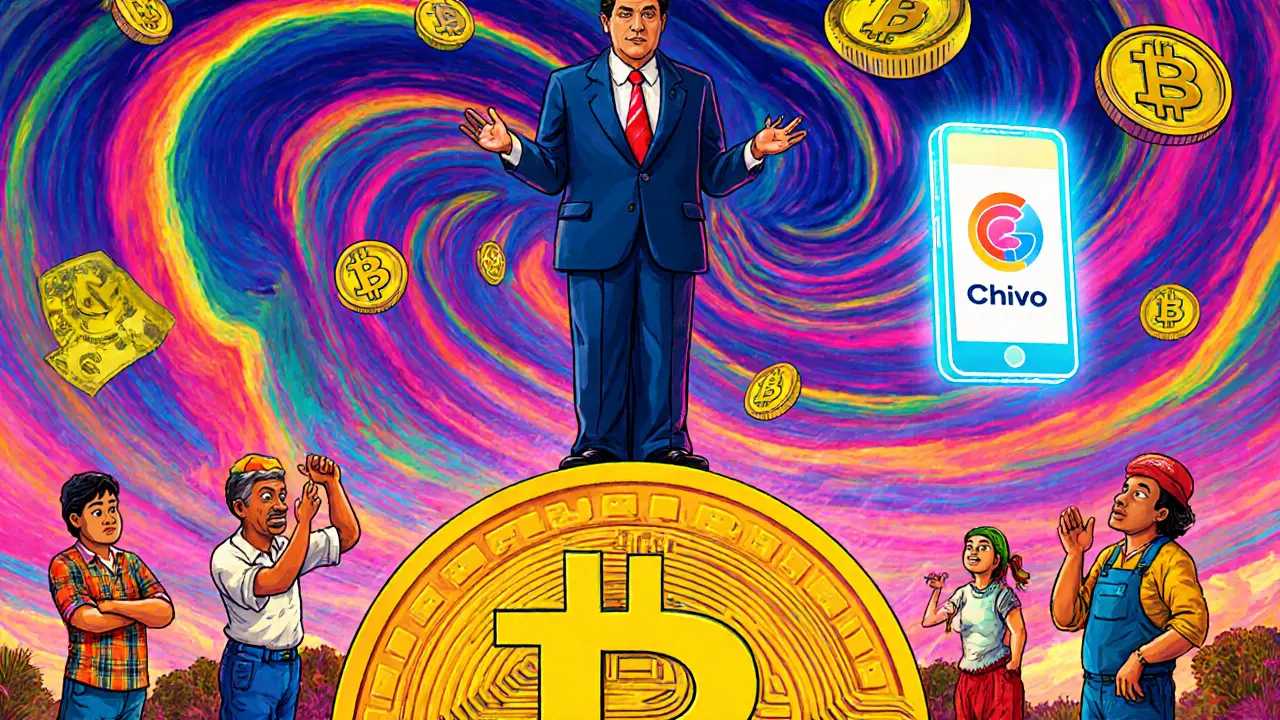

When El Salvador made Bitcoin legal tender in September 2021, it didn’t just shake up its own economy-it sent shockwaves through global financial systems. For the first time ever, a country treated a decentralized cryptocurrency like a national currency, requiring businesses to accept it alongside the U.S. dollar. But the world didn’t cheer. It watched. And many reacted with deep skepticism.

Why El Salvador’s Move Was Unprecedented

El Salvador didn’t just allow Bitcoin. It forced it. Under Article 7 of the Bitcoin Law, every business, from street vendors to banks, had to accept Bitcoin as payment for goods and services. No exceptions. That’s not the same as letting people use Bitcoin voluntarily. This was mandatory. And it came with a twist: the government built the Chivo Wallet app, gave people $30 in Bitcoin just for signing up, and set up automatic conversions so merchants could instantly turn Bitcoin into dollars. The goal? Cut remittance fees, bank the unbanked, and boost economic activity. But here’s the reality: only about 20% of businesses actually accepted Bitcoin in practice. And of the people who downloaded the app, more than 60% never made another transaction after their free Bitcoin ran out. Even worse-88% of businesses that did receive Bitcoin immediately sold it for dollars. That’s not adoption. That’s a cash-out.International Monetary Fund: A Warning Shot

The International Monetary Fund didn’t mince words. They called El Salvador’s move a serious risk to financial stability. Their report pointed to three red flags: Bitcoin’s wild price swings, lack of regulatory oversight, and the danger of undermining the dollar-based financial system El Salvador had relied on since 2001. The IMF warned that using Bitcoin as legal tender could make the country more vulnerable to cyberattacks, money laundering, and sudden capital flight. What made the IMF’s criticism sting was that they weren’t anti-crypto. They were pro-stability. In fact, over 100 countries were already developing their own central bank digital currencies-digital versions of their national money, fully controlled by their central banks. Countries like the Bahamas, Nigeria, and Jamaica launched theirs. These CBDCs kept government oversight, ensured price stability, and didn’t hand monetary control over to a decentralized network. El Salvador, by contrast, gave up control. And the IMF said: Don’t do that.Legal Experts Say It Violates Basic Rights

It’s not just economists who are alarmed. Legal scholars around the world are calling the forced tender clause unconstitutional in most democratic systems. Dror Goldberg, a historian of compulsory tender laws, explained that forcing someone to accept a payment they don’t want is a violation of property rights. In most countries, businesses can refuse cash. In the U.S., for example, a coffee shop can say, “We only take cards,” and it’s perfectly legal. But in El Salvador, if you’re selling a taco, you can’t say no to Bitcoin. That’s not just unusual-it’s dangerous. It turns every business owner into a reluctant participant in a volatile experiment. And if the value of Bitcoin drops after a sale but before the merchant converts it? They lose money. No recourse. No protection. The law doesn’t care.

The Crypto Community’s Enthusiasm vs. Reality

Meanwhile, Bitcoin supporters hailed El Salvador as a pioneer. They called it the first domino in a global shift toward decentralized money. Crypto influencers posted videos of Salvadorans using Chivo Wallet. Bitcoin price pumps followed. But the data told a different story. The people using Bitcoin the most weren’t the unbanked. They weren’t farmers or street vendors. They were young, tech-savvy, banked men in urban areas. The people the law was supposed to help-those without bank accounts-barely used it. The average user withdrew cash from a Chivo ATM less than three times a month. That’s not financial inclusion. That’s a novelty for the already connected. And the promised reduction in remittance fees? It barely moved the needle. Most Salvadorans still used traditional services like Western Union because they were more reliable, cheaper in practice, and didn’t require them to gamble on Bitcoin’s next price swing.Other Countries Are Watching-Cautiously

Since 2021, several other nations have floated the idea of adopting Bitcoin as legal tender. Nigeria, Kenya, and Argentina have all seen public debates. But none have followed through. Why? Because they saw what happened in El Salvador: low adoption, high volatility, and no real economic boost. Instead, countries are doubling down on CBDCs. India’s digital rupee, China’s digital yuan, and the European Central Bank’s digital euro are all moving forward with clear rules, government backing, and controlled supply. They want the efficiency of digital payments without the chaos of crypto. Even within the crypto world, many now admit El Salvador’s model was flawed. The mistake wasn’t using Bitcoin-it was forcing it. Making it mandatory turned off the very people it was meant to help. A better approach? Offer incentives. Educate. Build infrastructure. Let people choose.

Write a comment