International Response to Bitcoin: How Countries Are Regulating Crypto

When it comes to Bitcoin, a decentralized digital currency that operates without a central bank or single administrator. Also known as digital gold, it has forced governments to pick sides: regulate, ban, or embrace it. No other asset has triggered such a global split in policy. Some nations treat Bitcoin like cash. Others call it illegal. And a few are building entire financial systems around it.

The crypto regulation, the set of laws and rules governments impose on cryptocurrency trading, mining, and usage. Also known as digital asset regulation, it varies wildly by region. In the U.S., the CLARITY and GENIUS Acts gave exchanges clear rules, pulling banks back into crypto. In Switzerland, Zug’s DLT Act, a pioneering law that recognizes blockchain-based assets as legal property. Also known as distributed ledger technology law, it lets businesses tokenize real estate and pay taxes in Bitcoin. Meanwhile, Nigeria doesn’t ban exchanges—but only SEC-approved ones like Quidax can handle Naira. Morocco bans mining and cross-border crypto transfers, with fines up to $50,000 for violations. These aren’t random choices. They’re responses to control, fear, or opportunity.

Why Some Countries Fear Bitcoin, Others Chase It

When a country bans Bitcoin, it’s rarely about the tech. It’s about losing control over money flow. Central banks don’t like losing power to a system they can’t freeze, tax, or track. That’s why countries like Morocco and Nigeria crack down—especially when people use crypto to bypass currency controls. But places like Switzerland and the U.S. see something else: innovation, tax revenue, and global financial leadership. They don’t fight Bitcoin. They build rules around it.

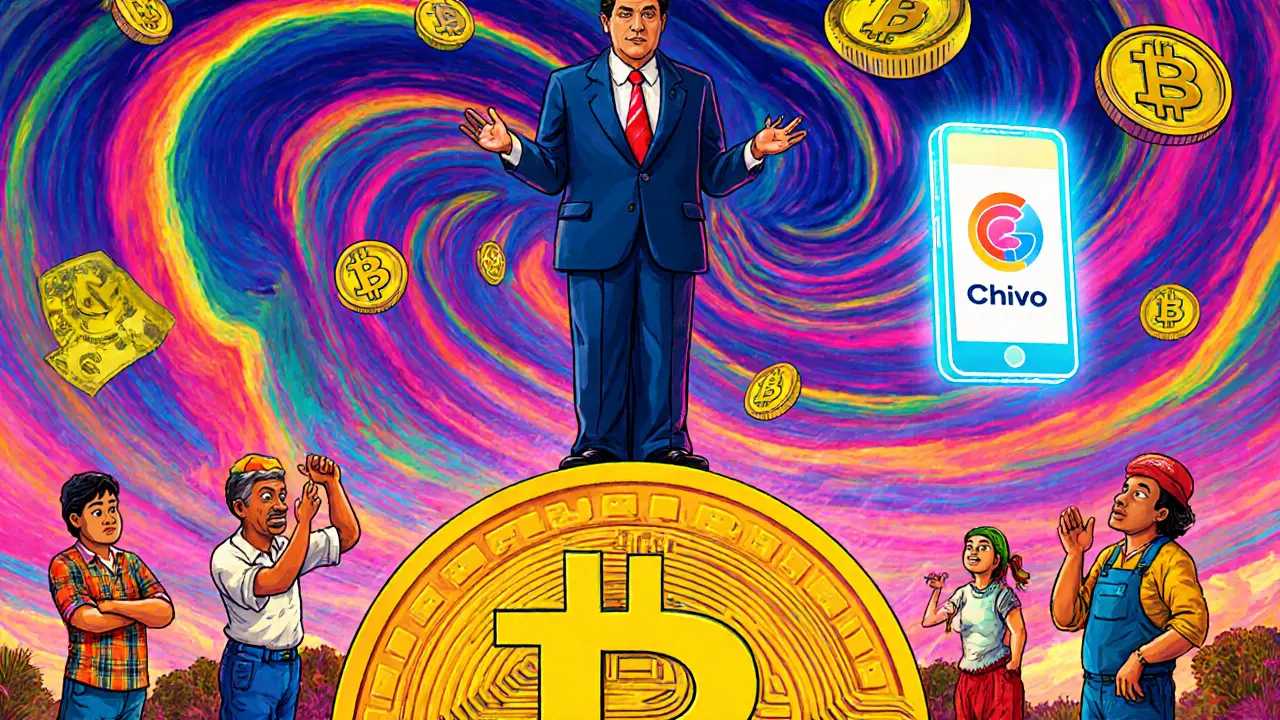

The crypto ban, a government decision to prohibit cryptocurrency transactions, mining, or ownership. Also known as crypto prohibition, it often backfires. Bans don’t stop people from using Bitcoin—they just push it underground. In Nigeria, people still trade crypto through peer-to-peer apps. In Morocco, traders use VPNs and offshore exchanges. Meanwhile, countries that welcome Bitcoin—like El Salvador, which made it legal tender—see new businesses, remittance savings, and tourism. The difference isn’t just policy. It’s vision.

What you’ll find below isn’t a list of headlines. It’s a real-world map of how Bitcoin is treated across borders. From fake airdrops pretending to be government-backed to exchanges that vanished overnight, these posts cut through the noise. You’ll see what’s legal in Zug, what’s dead in Nigeria, and why a $500 Twitter contest isn’t an airdrop—it’s a trap. No fluff. No hype. Just what’s actually happening, country by country.

How the World Reacted to El Salvador's Bitcoin Legal Tender Law

El Salvador made Bitcoin legal tender in 2021, but global reaction was skeptical. Despite government incentives, adoption remains low, businesses rarely accept it, and international institutions warn of financial risks. The experiment exposed the limits of forcing crypto adoption.