El Salvador Bitcoin Law: What It Means for Crypto, Regulation, and Global Adoption

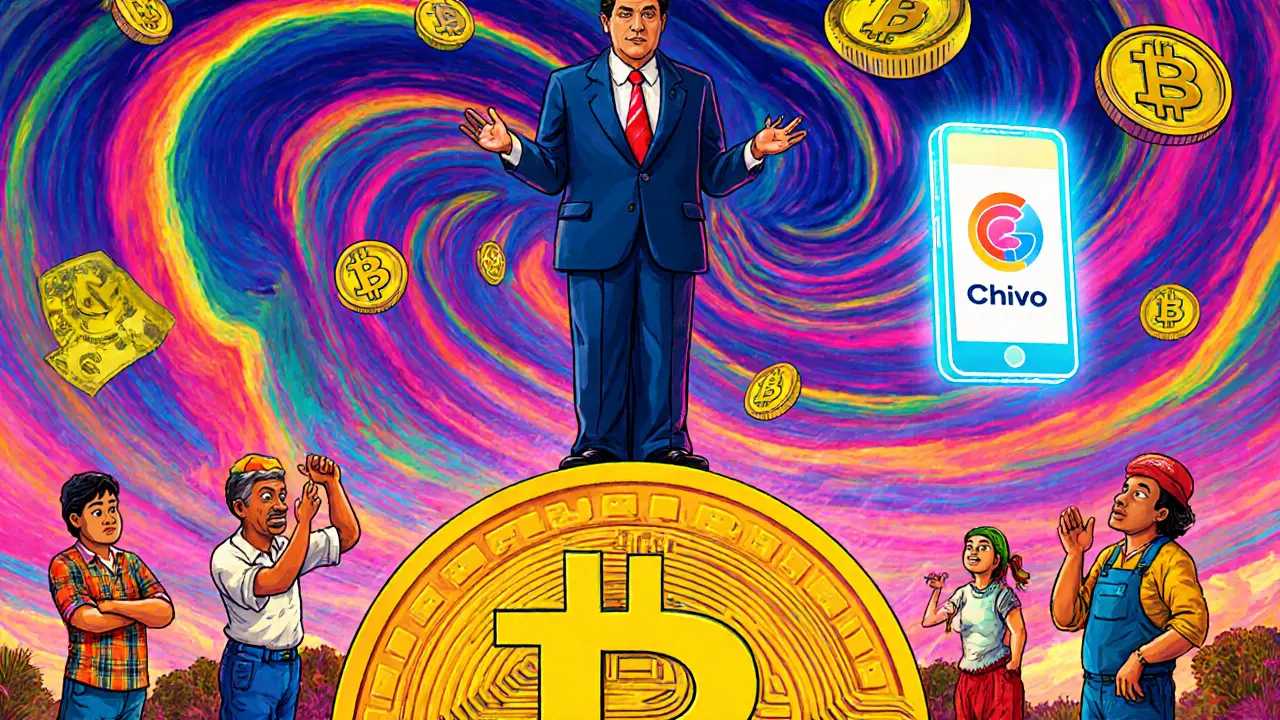

When El Salvador Bitcoin law, the landmark 2021 decision to make Bitcoin legal tender alongside the U.S. dollar. Also known as Bitcoin legal tender law, it was the first time any nation officially recognized a cryptocurrency as equal to its national currency. This wasn’t a trial run or a pilot program—it was a full legal shift. The government didn’t just allow Bitcoin. It forced businesses to accept it, built a national wallet app (Chivo), and even bought Bitcoin on the open market. The goal? Cut remittance costs, bank the unbanked, and attract crypto investment. But what actually happened? And why does it still matter in 2025?

The crypto regulation, the set of rules governments use to control how digital assets are used, taxed, and traded landscape changed overnight. While most countries kept Bitcoin as an asset or commodity, El Salvador treated it like cash. That meant merchants had to accept it for goods, banks had to handle Bitcoin transactions, and the state became a direct market participant. The El Salvador crypto, the ecosystem of users, businesses, and infrastructure built around Bitcoin use in the country didn’t magically become a crypto utopia. Many people still use dollars. The Chivo wallet had glitches. Some businesses refused Bitcoin. But the signal was loud: a sovereign nation was betting its economy on decentralized money. That scared traditional banks. It inspired other nations. And it forced the IMF, the World Bank, and the U.S. Treasury to respond.

Today, the El Salvador Bitcoin law is still standing—no repeal, no major rollback. But the story isn’t about success or failure. It’s about real-world testing. Did it reduce remittance fees? Yes, by about 20% for some users. Did it attract foreign investors? A few, but not enough to offset capital flight. Did it help the poor? Mixed results—some got free Bitcoin, others got confused or lost money to scams. The law didn’t fix poverty. But it proved one thing: a small country can challenge global financial norms. And that’s why analysts, traders, and regulators still watch El Salvador like a lab experiment.

What you’ll find below are real posts that dig into the ripple effects of this law. From how it influenced crypto rules in other countries, to scams that popped up using its name, to whether any other nation is even close to copying it. No fluff. Just facts about what worked, what broke, and what’s still on the line.

How the World Reacted to El Salvador's Bitcoin Legal Tender Law

El Salvador made Bitcoin legal tender in 2021, but global reaction was skeptical. Despite government incentives, adoption remains low, businesses rarely accept it, and international institutions warn of financial risks. The experiment exposed the limits of forcing crypto adoption.