Cryptocurrency Regulation: What’s Legal, What’s Not in 2025

When it comes to cryptocurrency regulation, the set of rules governments use to control how digital assets are traded, taxed, and issued. Also known as digital asset regulation, it’s no longer just a technical debate—it’s the difference between keeping your crypto safe or losing it to a banned exchange. In 2025, the rules aren’t the same everywhere. What’s legal in Switzerland is illegal in Morocco. What’s a tax-free investment in Zug is a felony in Nigeria if you use the wrong platform.

The CLARITY Act, a landmark U.S. law passed in 2025 that gives clear oversight to crypto exchanges and stablecoins finally ended years of regulatory chaos. Before this, the SEC could chase any project it wanted, but now there are defined rules for who needs a license, how stablecoins must be backed, and what counts as a security. The GENIUS Act, a companion law that protects innovation by limiting overreach from federal agencies means startups can build without fearing sudden shutdowns. These aren’t just buzzwords—they’re the reason banks are now talking to crypto firms again.

Meanwhile, the MiCA regulation, the European Union’s comprehensive framework for crypto assets, including tokenized real-world assets and stablecoins is forcing projects to prove they’re real. E Money (EMYC) became the first blockchain to fully comply, because without MiCA approval, no exchange in the EU will list it. That’s why projects like Sophon (SOPHON) or NFTP are dead ends—they have no legal structure, no audited code, and no path to compliance. If a token doesn’t fit under MiCA, CLARITY, or Switzerland’s DLT Act, it’s not just risky—it’s legally invisible.

And it’s not just about laws—it’s about enforcement. Morocco fines violators up to $50,000 for cross-border crypto transfers. Nigeria doesn’t ban exchanges, but only SEC-licensed ones like Quidax can handle Naira. Switzerland treats staking as a taxable event, while the U.S. doesn’t. You can’t guess your way through this. Every time you trade, stake, or claim an airdrop, you’re playing by rules that vary by country, platform, and even wallet type.

What you’ll find below isn’t a list of headlines. It’s a real-world map of what’s working, what’s fake, and what’s about to get shut down. From scams hiding behind fake airdrops to the one blockchain actually changing how real estate is traded, these posts cut through the noise. No theory. No hype. Just what’s legal, what’s not, and who’s getting left behind.

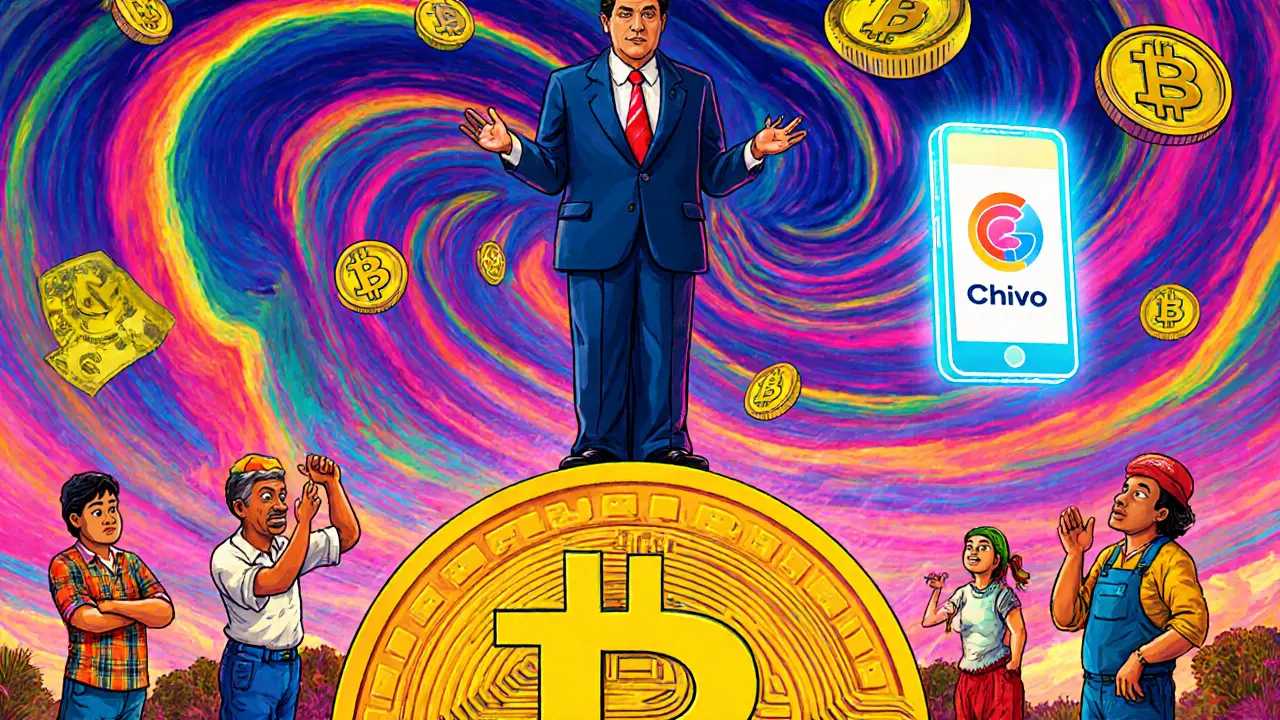

How the World Reacted to El Salvador's Bitcoin Legal Tender Law

El Salvador made Bitcoin legal tender in 2021, but global reaction was skeptical. Despite government incentives, adoption remains low, businesses rarely accept it, and international institutions warn of financial risks. The experiment exposed the limits of forcing crypto adoption.