Crypto Exchange: How to Choose, Compare, and Stay Safe

When working with Crypto Exchange, a platform that lets you buy, sell, or swap digital assets. Also known as digital asset exchange, it serves both hobby traders and professional investors looking for liquidity and price discovery.

Key Aspects of Crypto Exchanges

One of the first decisions is whether you need a Decentralized Exchange (DEX), a peer‑to‑peer marketplace that runs on smart contracts without a central authority. DEXs usually offer lower custody risk and often focus on specific token families, but they can suffer higher slippage on large orders. In contrast, centralized exchanges bundle order books, provide fiat on‑ramps, and often deliver faster execution, at the cost of trusting the platform with your funds.

Understanding Tokenomics, the economic design behind a cryptocurrency, including supply caps, inflation rates, and distribution mechanisms, is crucial when you compare exchanges. Some platforms list tokens with solid tokenomics that encourage holding and staking, while others feature hype‑driven assets with unclear future value. Spotting healthy tokenomics helps you avoid pumps that collapse after a listing.

Finally, Regulation, the legal framework governing how exchanges operate, from KYC/AML requirements to licensing and consumer protection, can make or break your experience. Exchanges that comply with local laws tend to have clearer dispute processes and better security audits. Ignoring regulatory signals can expose you to sudden shutdowns or frozen assets.

These three pillars—centralized vs. decentralized structure, tokenomics insight, and regulatory compliance—form a web of relationships that shape every trade you make. A solid crypto exchange encompasses both user‑friendly interfaces and robust security measures. It requires diligent research into the platform’s token listings, fee schedule, and liquidity depth. Regulation influences how exchanges implement KYC, while tokenomics drives the long‑term attractiveness of the assets you’ll hold.

Below you’ll find a curated collection of articles that walk you through specific exchanges, airdrop opportunities, compliance tips, and deeper dives into DeFi mechanics. Whether you’re scouting a new DEX, checking the safety of a newly launched token, or learning how to lower gas fees, the posts ahead give you actionable insights to make informed decisions.

Silk Road Crypto Exchange Review: The Darknet Marketplace That Changed Crypto Forever

Silk Road wasn't a crypto exchange - it was a darknet marketplace that used Bitcoin to sell illegal goods. Its rise and fall changed how governments view cryptocurrency forever.

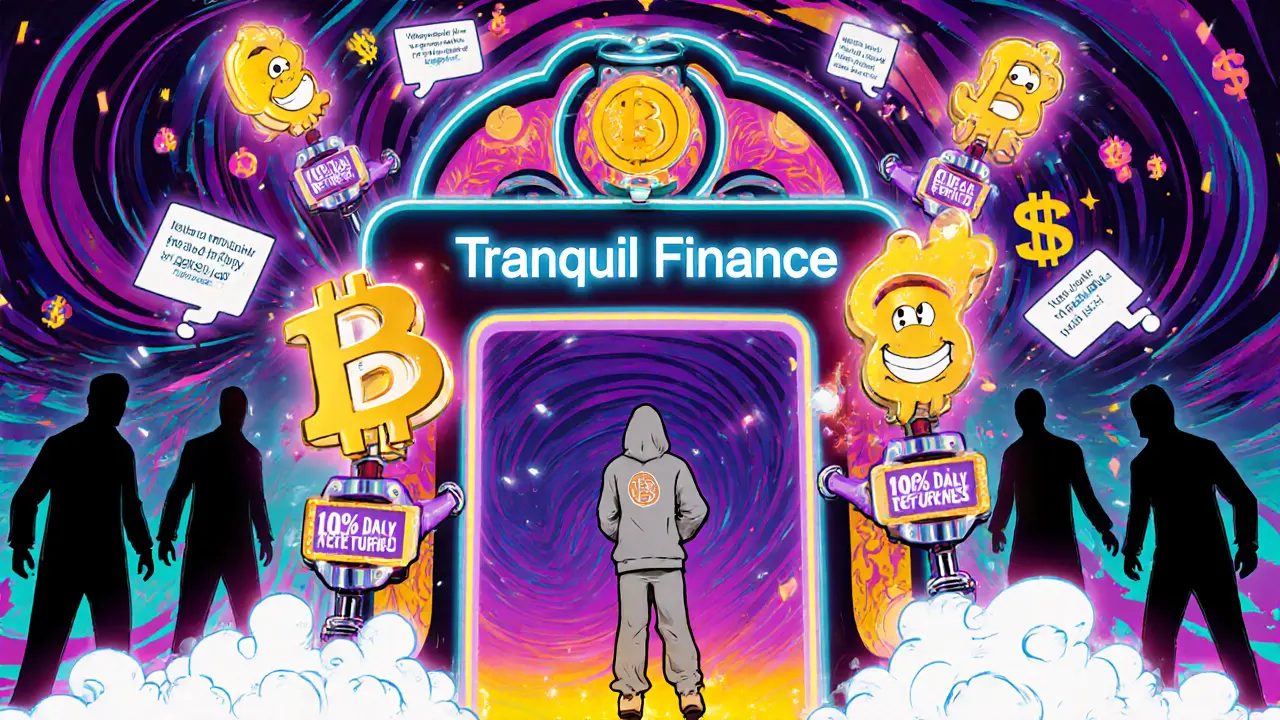

Tranquil Finance Crypto Exchange Review: Is It Legit or a Scam?

Tranquil Finance is not a legitimate crypto exchange. No credible reviews, audits, or user data exist for it. Learn why it's a scam and which real platforms to use instead in 2025.

Amaterasu Finance Crypto Exchange Review: Is It Still Operational in 2025?

Amaterasu Finance crypto exchange shows zero trading activity, a trust score of 2, and no user engagement. As of 2025, it's effectively dead. Avoid this platform and use established DEXs like Uniswap or PancakeSwap instead.

ChangeNOW Crypto Exchange Review 2025 - Fees, Security, Features

A 2025 review of ChangeNOW crypto exchange covering fees, security audit results, features, pros & cons, and step‑by‑step usage guide.

BTCEXA Exchange Review 2025: Is It Worth Your Crypto?

A detailed 2025 review of BTCEXA crypto exchange covering its claimed Australian registration, security, fees, user feedback, and how it compares to Coinbase, Kraken and Binance US.