Bitcoin Legal Tender: Where It’s Recognized, Why It Matters, and What’s Really Happening

When we talk about Bitcoin legal tender, a status that makes Bitcoin an official form of payment recognized by a government. Also known as official cryptocurrency status, it means businesses must accept Bitcoin for goods and services, just like dollars or euros. This isn’t just a tech trend—it’s a legal shift that’s changing how money works in real life. Only a handful of countries have made this move, and most of them are doing it for reasons that go far beyond technology.

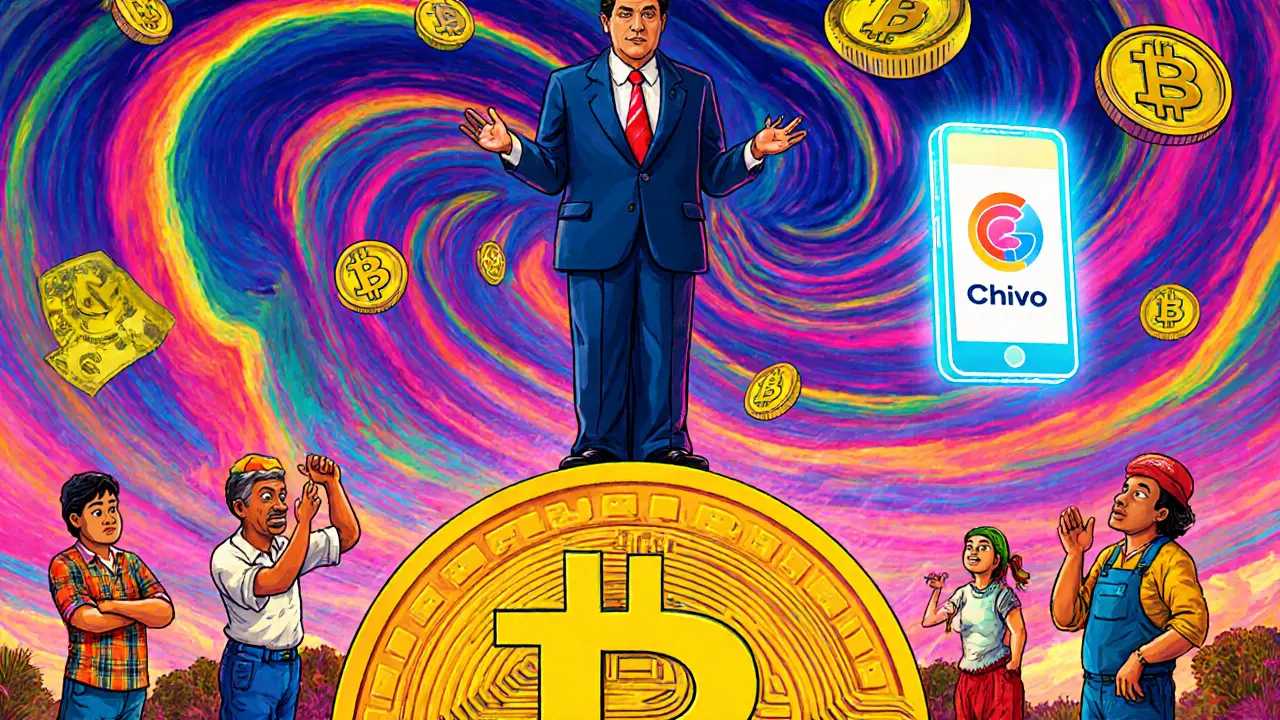

The most famous example is El Salvador, the first country to adopt Bitcoin as legal tender in 2021. Also known as Bitcoin nation, it made the switch to reduce reliance on the U.S. dollar, lower remittance fees, and attract crypto investors. But it wasn’t smooth. Many locals didn’t use it. ATMs broke. The IMF warned about risks. And today, Bitcoin usage there is still mostly for speculative trading, not daily shopping. Other places like the Central African Republic followed, but with even less adoption and more chaos. Meanwhile, countries like Switzerland and Zug are quietly building legal frameworks for crypto without calling it legal tender—focusing instead on tax clarity, business licenses, and asset tokenization.

Cryptocurrency regulation, the set of laws that govern how digital assets can be used, traded, and taxed. Also known as digital asset laws, it’s the real battleground—not whether Bitcoin is money, but who controls the rules. In 2025, the U.S. passed the CLARITY and GENIUS Acts to bring order to the market, while the EU’s MiCA regulation sets strict rules for stablecoins and exchanges. Meanwhile, places like Morocco and Nigeria ban certain crypto activities outright, not because they hate Bitcoin, but because they fear losing control over their currency systems. This isn’t about tech—it’s about power, money flow, and who gets to decide what counts as real value.

So what does this mean for you? If you hold Bitcoin, knowing where it’s legal tender doesn’t make it more valuable overnight. But it does tell you where it’s safer to spend, where governments might protect your rights, and where you could face fines or bans. The truth? Most people won’t use Bitcoin to buy coffee. But in places with unstable banks or high inflation, it’s becoming a lifeline. And that’s the real story behind Bitcoin legal tender—not the hype, not the charts, but the people using it when they have no other choice.

Below, you’ll find real breakdowns of where crypto is allowed, where it’s banned, and how governments are reacting—not with slogans, but with laws, fines, and shifting policies. No fluff. Just facts on what’s working, what’s failing, and what you need to know to stay safe in 2025.

How the World Reacted to El Salvador's Bitcoin Legal Tender Law

El Salvador made Bitcoin legal tender in 2021, but global reaction was skeptical. Despite government incentives, adoption remains low, businesses rarely accept it, and international institutions warn of financial risks. The experiment exposed the limits of forcing crypto adoption.