Bitcoin adoption: How it's really growing (and where it's hitting walls)

When we talk about Bitcoin adoption, the real-world use of Bitcoin as a payment method, store of value, or financial tool by individuals and institutions. Also known as cryptocurrency acceptance, it's not just about how many wallets exist—it's about whether people can actually use Bitcoin where they live, work, and shop. In 2025, adoption isn't a simple yes-or-no story. It's messy, uneven, and shaped by laws that change faster than the price chart.

Some places, like Zug, Switzerland, a global hub for crypto-friendly regulations and blockchain businesses, treat Bitcoin like any other asset. Taxes are clear, staking is legal, and businesses accept it without fear. Meanwhile, in Morocco, a country with strict foreign exchange controls that ban crypto payments and mining, owning Bitcoin might not be illegal—but spending it could cost you $50,000 in fines. That’s not adoption. That’s risk.

And it’s not just governments. Crypto exchanges, platforms where people buy, sell, or trade digital assets are being forced to pick sides. In Nigeria, only SEC-approved exchanges can handle local currency. In the U.S., new laws like the CLARITY and GENIUS Acts are finally giving banks the confidence to work with crypto firms. But in places with no clear rules, exchanges disappear overnight—or worse, they’re fake. FDEX? Not real. Tranquil Finance? Scam. These aren’t just bad platforms—they’re signs that adoption is still fragile.

Meanwhile, Bitcoin mining, the process of validating transactions and securing the network using powerful computers, has become a battle of cost and efficiency. In 2025, only miners with access to cheap electricity and top-tier ASIC hardware survive. Most hobbyists lose money. That’s why adoption isn’t just about wallets—it’s about infrastructure. Can you mine it? Can you spend it? Can you earn interest on it? If the answer’s no, then you’re not part of adoption—you’re just watching.

What you’ll find below isn’t a list of hype. It’s a record of what’s real, what’s fake, and what’s legally possible. From tokenized real estate in the EU to airdrop scams in Nigeria, from dead exchanges in the UAE to the quiet rise of MiCA-compliant blockchains—this collection shows Bitcoin adoption not as a trend, but as a patchwork of rules, risks, and real people trying to make it work.

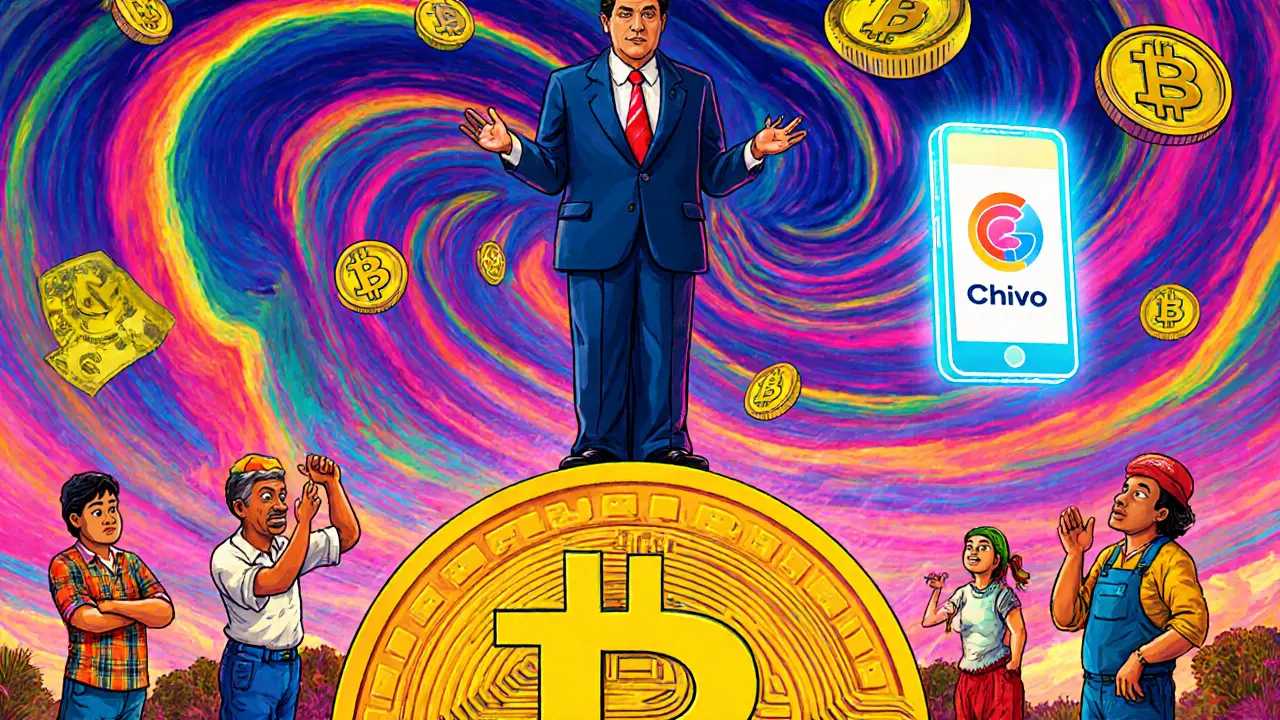

How the World Reacted to El Salvador's Bitcoin Legal Tender Law

El Salvador made Bitcoin legal tender in 2021, but global reaction was skeptical. Despite government incentives, adoption remains low, businesses rarely accept it, and international institutions warn of financial risks. The experiment exposed the limits of forcing crypto adoption.