When you buy an NFT, you’re not just buying a digital image. You’re buying into a system that’s supposed to keep paying the artist every time it changes hands. That’s the promise of NFT royalties. But here’s the problem: not all platforms make that promise real. Some enforce it. Some ignore it. And others pretend to care while quietly letting buyers skip out.

How NFT Royalties Are Supposed to Work

NFT royalties are automatic payments-usually 5% to 10%-that go to the original creator every time their NFT is resold. It’s built into the smart contract when the NFT is minted. The idea is simple: if your art sells for $10,000 on the secondary market, you get $500. No paperwork. No chasing buyers. Just code doing its job.

This system started with Ethereum’s ERC-721 standard in 2017, but it didn’t become common until 2020-2021. Platforms like OpenSea, Rarible, and Foundation built it in. For a while, it worked. Creators earned thousands in passive income. Artists like Tyler Hobbs and Fewocious made careers out of it.

But here’s what most people don’t realize: blockchains can’t force anyone to pay royalties. They can only record what happens. If a marketplace chooses to ignore the royalty code, there’s nothing stopping them. The blockchain doesn’t police. It just logs.

OpenSea: The Enforcer (Mostly)

OpenSea still handles about 65% of all Ethereum NFT trades. And it’s the most consistent when it comes to royalties. It enforces them on collections-meaning if a creator sets a 10% royalty on their entire collection, every resale on OpenSea pays it.

They also have a tool called the Operator Filter Registry. Creators can add code to their smart contracts that blocks sales on platforms that don’t honor royalties. Tyler Hobbs used it to blacklist Magic Eden and LooksRare in 2022 after they dropped enforcement.

But here’s the catch: OpenSea only enforces royalties at the collection level. If you mint individual NFTs outside the collection structure, royalties might not apply. And if someone sells your NFT on X2Y2 or Blur, OpenSea can’t stop it. You still get paid on OpenSea-but not elsewhere.

OpenSea’s max royalty rate is 10%. It’s not much, but it’s reliable. In 2024, one creator reported earning 2.3 ETH in royalties from just 10 NFTs over two years. That’s over $6,000 in passive income. For many, it’s the difference between art as a hobby and art as a job.

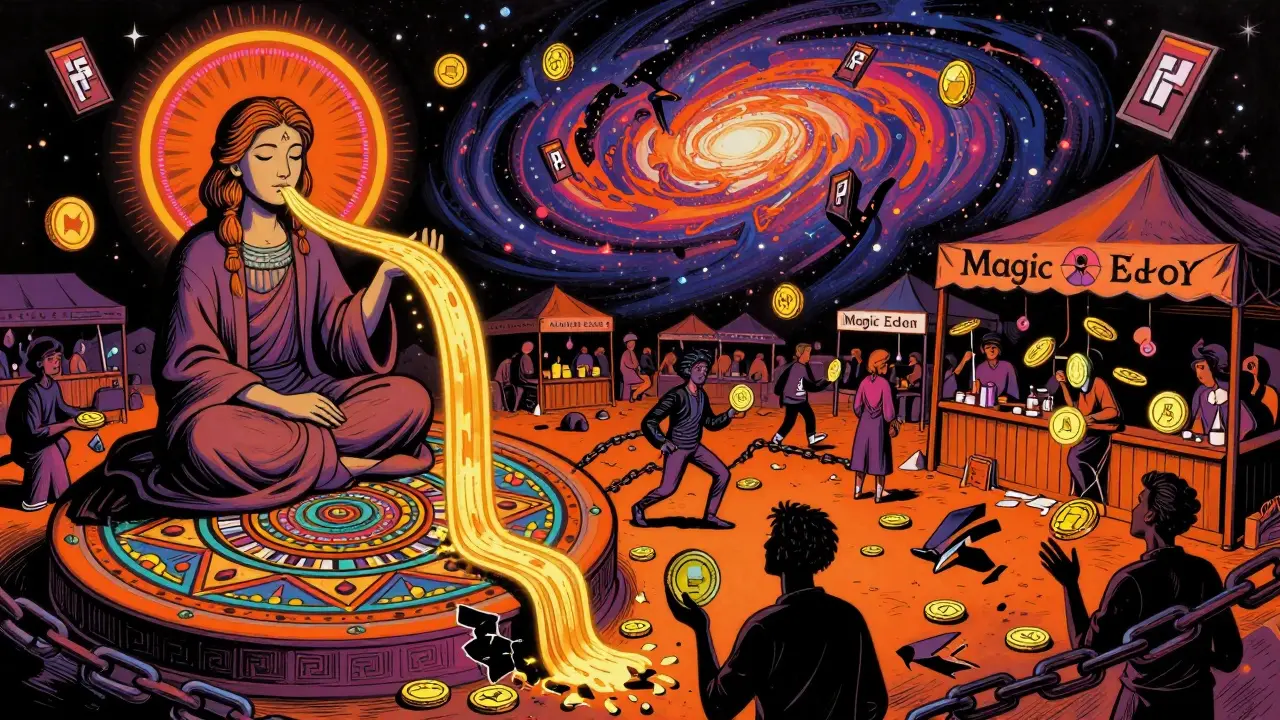

Magic Eden: The Flip-Flopper

Magic Eden dominates Solana NFT trading-about 80% of volume. But their royalty story is messy.

In 2022, they dropped mandatory royalties. They claimed it was to boost liquidity. What actually happened? Royalty collection rates for top collections fell from 80% to under 20%. One artist said it ruined their ability to pay rent.

In early 2025, they rolled out ‘Royalty Shield’-an optional incentive program. Buyers who honor royalties get bonus tokens. But only 35% of traders are using it. That means 65% are still skipping payments.

Trustpilot reviews are full of anger. ‘I made $12,000 in primary sales,’ wrote one creator in March 2025. ‘I’ve earned $1,200 in royalties since then. That’s not a bonus-it’s the point.’

Magic Eden’s problem isn’t just policy. It’s trust. Creators who minted on Magic Eden before August 2022 are now stuck. Their NFTs can be resold without paying a cent. And there’s no way to fix it.

Rarible: The Wildcard

Rarible lets creators set royalties up to 50%. That’s higher than any other major platform. And it’s not just a number-it’s a statement.

One digital artist sold a piece for $500 in 2022. It resold 17 times over 18 months. Total royalties: $47,000. That’s not a fluke. It’s the result of a creator choosing a platform that lets them capture real value.

But Rarible has its own flaw: cross-platform incompatibility. If someone buys your NFT on Rarible and sells it on OpenSea, OpenSea won’t pay the royalty unless it’s part of a collection with enforced terms. So you lose money the moment your NFT leaves your chosen platform.

Rarible also has the weakest creator support. No dedicated help desk. No clear guides. If you mess up your royalty address, you’re on your own. And 37% of creator issues on Reddit are due to wrong wallet addresses being set during minting.

Blur and X2Y2: The Royalty Killers

Blur launched in 2023 with one rule: no royalties. Ever. Their pitch? ‘More volume for traders.’ And it worked. They stole market share from OpenSea by letting buyers keep 100% of resale profits.

But they didn’t stop there. They created a token system-BLUR-that rewards traders who *do* pay royalties. So now, if you want to earn BLUR tokens, you have to pay creators. It’s not enforcement. It’s bribery.

X2Y2 did the same thing. They dropped royalties in 2023, then brought them back in January 2023 after backlash. The flip-flop confused creators. Some minted expecting payments. Others didn’t. Now, even if you buy on X2Y2, you can’t be sure if the seller paid the artist.

These platforms are why effective royalty rates dropped from 8-10% in 2021 to just 0.4% on some marketplaces. It’s not broken code. It’s broken incentives.

Solanart: The Zero-Royalty Zone

If you want to make sure a creator gets nothing, mint on Solanart. It’s the only major Solana marketplace that doesn’t even pretend to support royalties. Zero. Nada.

Reddit threads like ‘Solanart’s complete disregard for creator royalties is killing the ecosystem’ have over 140 upvotes. Creators who used Solanart say they’ve earned $0 in secondary sales. Even if their NFTs sold for $10,000.

It’s not just unethical. It’s economically destructive. When buyers know they can avoid paying, they undervalue the art. And creators have less incentive to make new work.

Cardano: The Quiet Winner

While everyone was fighting over royalties, Cardano quietly built a system where royalties are mandatory. No opt-out. No loopholes.

By October 2023, Cardano’s NFT trading volume surpassed Solana’s-not because of hype, but because artists trusted it. If you mint on Cardano, you get paid every time. Period.

It’s not flashy. It doesn’t have celebrity NFTs. But it’s the only major chain where the system works as intended.

What This Means for Creators

If you’re making NFT art, here’s what you need to do:

- Choose your platform before minting. Don’t mint on Magic Eden if you want royalties. Don’t mint on Solanart at all.

- Use OpenSea for Ethereum. It’s the most reliable, even with its 10% cap.

- Use Rarible if you want higher rates. But warn buyers that royalties might not follow the NFT off-platform.

- Use Cardano if you want guaranteed payments. It’s the only chain where the system works without trust.

- Never mint individual NFTs without a collection. OpenSea won’t enforce royalties on them.

- Double-check your royalty wallet address. A single typo means $0 forever.

There’s no universal fix. No blockchain magic. Just choices. And every choice has consequences.

The Future: Will Royalties Survive?

Analysts see three possible paths:

- Standardization: A cross-platform royalty protocol like Royalty Registry takes over. 45% chance by 2027.

- Two-Tier Market: High-value art keeps royalties. Low-value NFTs don’t. 30% chance.

- Complete Collapse: Royalties vanish as competition forces all platforms to drop them. 25% chance.

Right now, the market is split. Buyers choose platforms based on price. Creators choose based on payment. And the middle ground? It’s disappearing.

The creators who thrive aren’t the ones chasing trends. They’re the ones who picked platforms that protect their work-and stuck with them.

What You Should Do Today

If you’re a creator:

- Check where your NFTs are listed. Are royalties being paid?

- Look at your wallet. How much have you earned since launch?

- If it’s less than 5% of total resale value, you’re being underpaid.

- Consider moving future work to OpenSea or Cardano.

If you’re a buyer:

- Ask: ‘Does this platform pay royalties?’

- If the answer is ‘I don’t know,’ walk away.

- Support platforms that pay creators. It’s not charity-it’s sustainability.

NFT royalties aren’t perfect. But they’re the only thing keeping digital art alive as a profession. If you ignore them, you’re not saving money. You’re killing the ecosystem.

Do NFT royalties work on all blockchains?

No. Ethereum uses EIP-2981, Solana uses Metaplex’s Creator Standard, and Cardano has its own mandatory system. Each platform implements royalties differently, and some don’t enforce them at all. A royalty set on Ethereum won’t carry over to Solana unless the marketplace specifically supports cross-chain royalty tracking-which very few do.

Can I change my royalty rate after minting an NFT?

Generally, no. Royalty percentages are written into the smart contract at minting and can’t be changed afterward. Some platforms like OpenSea allow creators to update collection-level royalties, but only if the collection was created with that flexibility. For most NFTs, the rate is permanent. That’s why it’s critical to set it correctly the first time.

Why do some platforms allow 50% royalties while others cap at 10%?

It’s about philosophy. Rarible believes creators should control their earnings, even if it means higher prices. OpenSea prioritizes liquidity and buyer experience, so it caps royalties to keep NFTs affordable. Higher royalties can reduce primary sales because buyers know they’ll pay more later. That’s why many creators set lower rates-5-10%-to balance income and sales volume.

If I sell my NFT on OpenSea, but the buyer resells it on Blur, do I still get paid?

No. OpenSea only pays royalties on sales that happen on OpenSea. If the NFT is moved to Blur, X2Y2, or any other platform that doesn’t enforce royalties, you won’t get paid. This is why many creators blacklist platforms like Blur and Magic Eden-they know their income will vanish if buyers use them.

Are NFT royalties legal?

Right now, they’re not legally binding-they’re contractual terms enforced by marketplace rules, not law. The SEC hasn’t ruled them as securities, but in 2024, they warned that NFTs marketed as investment vehicles with guaranteed royalties could be classified as such. So while royalties aren’t illegal, they exist in a gray zone. Their future depends on market adoption, not regulation.

What happens if I set my royalty address to the wrong wallet?

You lose all future royalties. There’s no way to recover them. This is the most common mistake creators make. A single typo in the wallet address means payments go to a dead end. Always double-check your address before minting. Use a test transaction with a small amount to confirm the wallet receives funds. If you’ve already minted and made a mistake, you’re stuck.

Write a comment