As of June 1, 2025, owning, trading, or mining any cryptocurrency in China is illegal. This isn't a gray area. It’s a full legal ban with real consequences. If you’re in China-whether you’re a citizen, tourist, or expat-and you hold Bitcoin, Ethereum, or any other digital token, you’re breaking the law. Not just technically, but legally. The government doesn’t just discourage it. It actively shuts down access, freezes assets, and prosecutes violators.

How China Went From Crypto Hub to Crypto Ban

In 2017, China was one of the biggest crypto markets in the world. Mining rigs filled warehouses in Sichuan and Inner Mongolia. Trading volumes on Chinese exchanges like Huobi and OKEx rivaled those in the U.S. and Europe. People bought Bitcoin like it was gold. The government didn’t stop them-yet. By 2021, things started shifting. The People’s Bank of China banned financial institutions from offering crypto services. Exchanges were forced to shut down their mainland operations. Mining was targeted for its energy use. But individuals could still hold crypto. It was messy, but not illegal. Then came June 1, 2025. Circular No.237 made everything clear: all cryptocurrency activity is illegal. Not just exchanges and mining. Not just ICOs. Everything. Holding Bitcoin in a wallet. Trading on Binance. Using a crypto debit card. Even promoting crypto on social media. All of it is now classified as an illegal financial activity.What’s Actually Banned?

The ban covers every single layer of crypto activity:- Buying or selling cryptocurrency with RMB or any other currency

- Operating or using cryptocurrency exchanges

- Mining Bitcoin, Ethereum, or any other coin

- Providing price data, trading tools, or wallet services for crypto

- Accepting crypto as payment for goods or services

- Advertising or marketing crypto to Chinese residents

- Using decentralized finance (DeFi) platforms or NFT marketplaces

What Happens If You Get Caught?

The penalties aren’t theoretical. In 2024, a man in Guangzhou was fined 200,000 RMB (about $27,500 USD) and given a suspended prison sentence for running a crypto trading group. His group had 300 members. He didn’t run an exchange-he just helped people buy and sell. That was enough. Foreigners aren’t exempt. A Canadian citizen living in Shanghai was arrested in October 2024 for using a VPN to access Binance. He was deported after 45 days in detention and banned from re-entering China for five years. Financial institutions are required to monitor accounts for crypto-related transactions. If your bank sees you transferring money to a known crypto exchange-even once-it flags you. You could be called in for questioning. Your account might be frozen. Your credit score could drop.Blockchain Is Fine. Crypto Is Not.

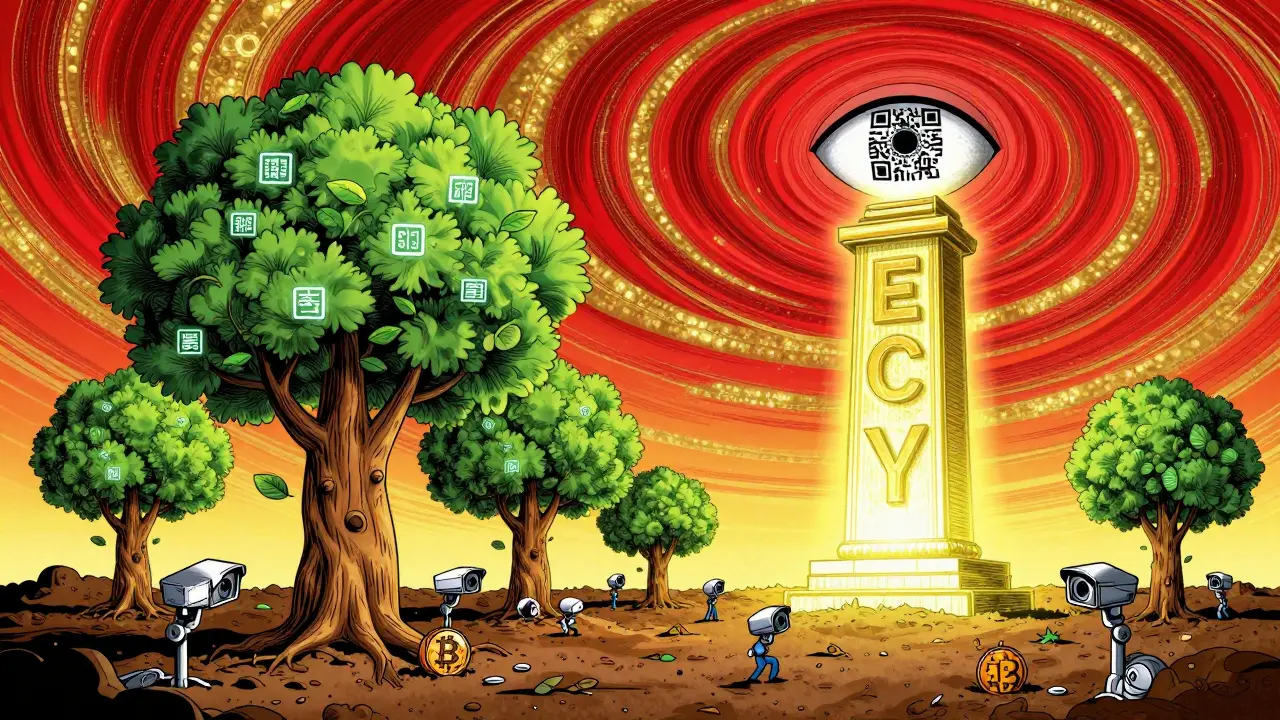

Here’s the twist: China doesn’t hate technology. It hates decentralization. The government still heavily invests in blockchain. State banks use blockchain for supply chain tracking. Local governments use it for land registries and tax records. Universities teach blockchain engineering. The state even issued its own digital currency-the e-CNY-in 2020, and by 2025, over 400 million people had used it. The difference? The e-CNY is fully controlled by the People’s Bank of China. Every transaction is tracked. Every user is verified. There’s no anonymity. No decentralization. No risk to state power. Crypto, on the other hand, is anonymous, borderless, and out of government control. That’s why it’s banned. It’s not about energy use or fraud. It’s about control.

The Digital Yuan Is the Real Goal

China’s endgame isn’t just to ban crypto. It’s to replace it. The e-CNY isn’t just a digital version of cash. It’s a surveillance tool. The government can set expiration dates on payments. Block spending in certain categories. Track exactly where money goes. No more cash. No more crypto. Just state-approved digital money. By 2025, the e-CNY was used in over 70% of all digital payments in pilot cities like Beijing and Shenzhen. The government is now pushing it into public services: paying for buses, school fees, medical bills. No choice. No alternative. This is why the crypto ban won’t be lifted. The digital yuan is too successful. Too useful. Too powerful for the state to ever allow competition.What About Hong Kong?

Hong Kong is different. It’s part of China, but it has its own financial rules. In May 2025, Hong Kong passed the Stablecoin Bill, making it one of the first places in the world to legally regulate stablecoins. Exchanges like Bybit and OKX have moved their Asia headquarters there. But here’s the catch: You can trade crypto in Hong Kong. But if you’re a mainland Chinese citizen, you’re still not allowed to access those services from inside China. The Great Firewall blocks access. Banks block transfers. VPNs are monitored. So while Hong Kong offers a legal crypto environment, it’s not a loophole for mainlanders.What’s Next for Crypto in China?

Don’t expect a reversal. The ban is too deep. Too integrated into China’s financial control system. The state has spent billions on surveillance tech, AI monitoring, and blockchain-based tracking systems-all designed to eliminate private digital money. Even if global crypto prices surge again, China won’t open up. It’s not about market trends. It’s about power. The government sees crypto as a threat to its monetary sovereignty. And it’s not willing to risk that. For now, the only legal digital money in China is the one issued by the state. Everything else? Illegal. Unprotected. Dangerous.

What If You’re a Foreigner Living in China?

If you’re a foreigner living or working in China, here’s what you need to know:- Don’t hold crypto in a wallet you access from within China.

- Don’t use crypto apps on your phone while you’re in the country.

- Don’t use a VPN to access exchanges-even if it’s legal in your home country.

- Don’t accept crypto as payment, even from friends.

- Don’t try to mine-even with a single rig.

Write a comment