KuMEX Trading Fee Calculator

Calculate Your KuMEX Trading Costs

Estimate your fees and margin requirements for Bitcoin futures trading on KuMEX. Note: U.S. users are not eligible to trade.

When you're looking for a crypto futures exchange with low fees and solid tech, KuMEX comes up often. But here’s the thing: KuMEX isn’t just another trading platform. It’s the futures arm of KuCoin, built for traders who want speed, leverage, and institutional-grade systems - but only if you’re not in the U.S.

What KuMEX Actually Offers

KuMEX is not a standalone exchange. It’s a dedicated futures trading platform, meaning you can only trade crypto derivatives - not buy Bitcoin with a credit card or swap altcoins like you would on Binance or Coinbase. Its core offering? Bitcoin futures. That’s it. While competitors like Binance Futures or Bybit offer dozens of trading pairs, KuMEX keeps it focused. And that focus shows in performance.

The platform runs on a trading engine that handles up to 1 million transactions per minute with under 1 millisecond latency. That’s not marketing fluff - it’s what serious traders need when markets swing 5% in 30 seconds. If you’re scalping or running automated bots, this matters. The system doesn’t freeze during high volatility. It doesn’t lag when you hit ‘market sell’ on a 50x position. It just works.

Two Interfaces for Two Types of Traders

KuMEX doesn’t force everyone into the same complex dashboard. You get two options: Lite and Advanced.

- Lite mode is clean, simple, and built for people who want to trade futures without drowning in charts and indicators. It shows price, leverage, and position size in one view. You pick your leverage, set your stop-loss, and hit trade. No confusion.

- Advanced mode is where pros live. Full depth charts, multiple order types (limit, stop-limit, trailing stop), API access, and custom risk settings. It’s almost identical to what you’d find on Deribit or BitMEX - just with KuCoin’s backend.

This dual-interface setup is rare. Most platforms either overwhelm beginners or dumb things down too much. KuMEX nails the balance.

Fees That Actually Beat the Competition

Trading fees are where KuMEX pulls ahead. The taker fee is 0.06%. That’s lower than Binance Futures (0.04% for makers, 0.06% for takers - but only if you’re holding KCS) and significantly cheaper than Bybit (0.075% taker). The maker rebate is 0.025%, which is standard, but the real win is consistency. You don’t need to hit high volume tiers to get the low fee. It’s flat across all accounts.

Compare that to other platforms that hide lower fees behind loyalty programs or token staking requirements. KuMEX doesn’t play games. If you trade, you pay 0.06%. No strings attached.

Security: Backed by KuCoin’s Infrastructure

KuMEX doesn’t run its own cold wallets. It piggybacks on KuCoin’s security system. That means 95%+ of funds are stored in offline, multi-signature cold storage. The rest - the small amount needed for daily withdrawals and trades - lives in hot wallets with additional layers of encryption and real-time monitoring.

They also have an insurance fund. Here’s how it works: when a leveraged position gets liquidated, the margin left over doesn’t vanish. It goes into the insurance fund. That fund then covers losses if the market moves too fast and liquidations don’t fully cover negative equity. It’s a buffer for traders. You don’t get wiped out because someone else’s position blew up. That’s not common on every exchange.

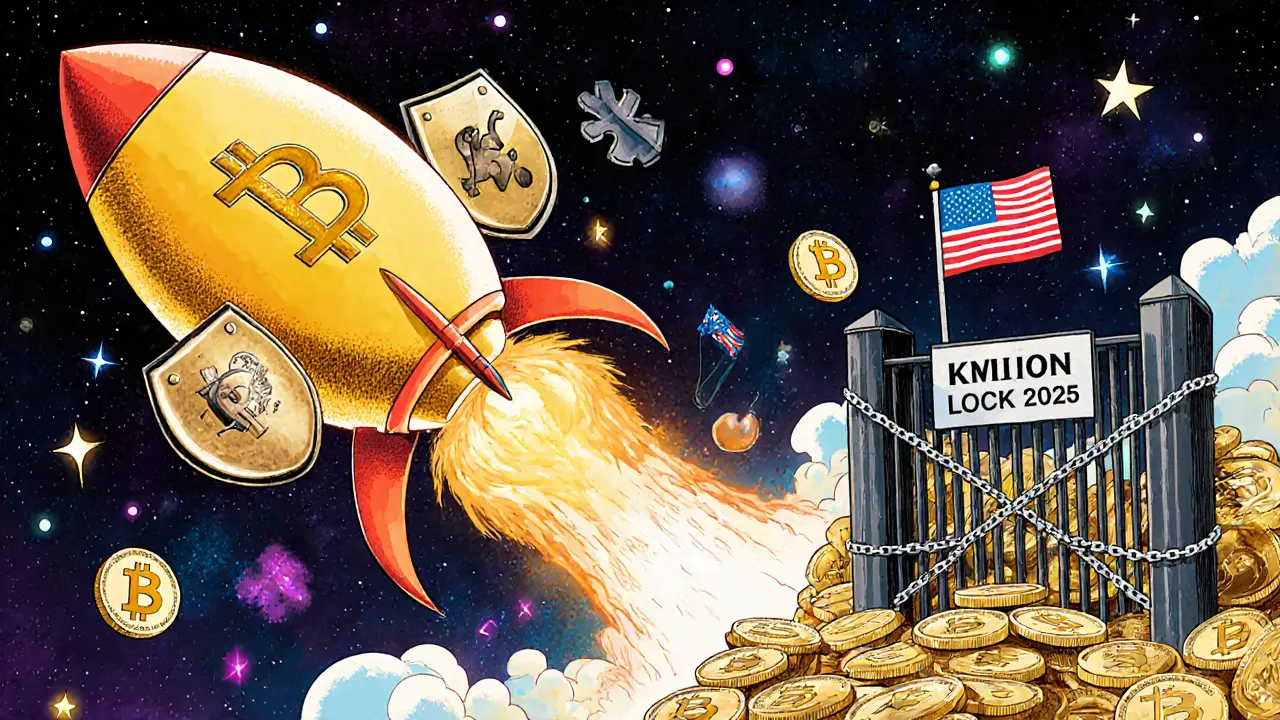

Regulatory Landmine: U.S. Users Are Blocked

This is the biggest caveat. In January 2025, KuCoin pleaded guilty to violating U.S. regulations and agreed to shut down all U.S. trading operations for at least two years. That means if you’re in the United States:

- You can’t deposit funds.

- You can’t open new positions.

- You can’t use the platform for trading.

The only thing you can do? Withdraw any crypto you already had on the platform before the ban. That’s it. If you’re a U.S. resident, KuMEX is not an option. Not even for testing. The sandbox (testnet) is also blocked for U.S. IPs.

This isn’t a minor hiccup. It’s a massive blow to growth. KuMEX used to be popular globally. Now, it’s effectively locked out of the largest crypto market in the world. That affects liquidity, trading volume, and long-term development.

What’s Missing?

KuMEX isn’t perfect. Its biggest weakness? Asset selection. You get Bitcoin futures. That’s it. No Ethereum futures. No Solana. No Cardano. No altcoins at all. That’s fine if you’re a BTC trader. But if you want to hedge your ETH position or trade Dogecoin leveraged, you’re out of luck.

Also, customer support, while better than average, isn’t flawless. Responses can take 12-24 hours during busy periods. There’s no live chat on the platform - just email and ticket systems. For traders who need instant help during a liquidation event, that’s a risk.

And while the API is powerful, documentation isn’t as polished as Binance’s or Deribit’s. You’ll need to dig into forums or GitHub to find working examples. It’s doable, but not beginner-friendly.

Who Is KuMEX For?

KuMEX is ideal for:

- Experienced traders who focus on Bitcoin futures and want low fees.

- Users already on KuCoin who want seamless integration between spot and futures trading.

- Developers who need a reliable API for automated trading bots.

- Traders outside the U.S. who value speed and security over asset variety.

KuMEX is NOT for:

- U.S. residents - you’re blocked.

- Beginners who want to buy crypto with a bank card.

- Traders who want to hedge altcoins or trade multiple assets.

- People who need 24/7 live support.

Testnet: Trade Risk-Free Before You Commit

One of the best features KuMEX offers? A full testnet environment. You can sign up at testnet.kumex.com and get $100,000 in fake BTC to practice. You can test leverage, stop-losses, trailing orders, and even your own trading bots - with zero financial risk.

It’s not a demo. It’s a mirror of the live platform. The charts, the order book, the liquidation triggers - all identical. If you’re new to futures trading, this is your safest way to learn.

Final Verdict: Solid, But Narrow

KuMEX delivers on what it promises: fast, low-cost Bitcoin futures trading with institutional-grade security. If you’re outside the U.S. and you trade BTC, it’s one of the best options you have. The fee structure is transparent, the interface is clean, and the infrastructure is proven.

But it’s not a one-stop shop. You can’t trade anything but Bitcoin. You can’t use it if you’re American. And if you need a wide range of assets or instant support, you’ll need to look elsewhere.

For its niche, KuMEX is excellent. But its niche is small. And with regulators breathing down its neck, the platform’s future depends on whether KuCoin can expand its asset list and survive the next wave of global compliance crackdowns.

Is KuMEX still available for U.S. users?

No. As of January 2025, KuCoin (and KuMEX) are banned from serving U.S. residents. Americans can only withdraw existing funds - no deposits, no trading, no access to the platform. The testnet is also blocked for U.S. IPs.

Does KuMEX support altcoin futures?

No. KuMEX only offers Bitcoin (BTC) futures. There are no Ethereum, Solana, or other altcoin derivatives available. This is a major limitation compared to competitors like Binance Futures or Bybit, which offer dozens of trading pairs.

What are KuMEX’s trading fees?

KuMEX charges a 0.06% taker fee and gives a 0.025% maker rebate. These fees are flat across all account levels - no volume tiers required. This makes it cheaper than many competitors for active traders.

Is KuMEX safe?

Yes, for a futures exchange. It uses KuCoin’s institutional-grade security: 95%+ cold storage, multi-signature wallets, and an insurance fund that protects traders from cascading liquidations. It’s not immune to exchange hacks, but its infrastructure is among the most secure in the derivatives space.

Can I use KuMEX with a mobile app?

There is no dedicated KuMEX mobile app. However, you can access the platform through the KuCoin app’s futures section. The interface is simplified compared to the desktop version, but it supports core features like leverage trading and stop-loss orders.

How does KuMEX compare to Bybit or Binance Futures?

KuMEX has lower fees than Bybit and matches Binance’s taker fee - but without needing to hold KCS. It’s faster and more reliable than Binance during high volatility. But Binance and Bybit offer far more trading pairs and better mobile apps. KuMEX wins on fee simplicity and Bitcoin-specific performance; others win on variety and accessibility.

Do I need to complete KYC to use KuMEX?

Yes. KuMEX uses KuCoin’s KYC system. You must complete identity verification on KuCoin before you can trade on KuMEX. This includes uploading government-issued ID and a selfie. No KYC = no trading.

Write a comment