When you hear "decentralized exchange," you imagine a system with no bosses, no middlemen, no government rules. A platform that runs on code, not corporate offices. But dYdX - one of the biggest names in crypto derivatives - tells a different story. It claims to be decentralized. It markets itself as permissionless. Yet, it blocks users from over 20 countries. And if you try to sneak in with a VPN, it doesn’t just say no - it locks your account down completely.

How dYdX Blocks Users - Even If You Own the Wallet

dYdX doesn’t shut down your wallet. It doesn’t freeze your crypto on the blockchain. Instead, it does something more subtle: it turns your account into a ghost. If you’re in a restricted country and log in, you’ll see a red banner. You can’t deposit. You can’t open new trades. You can’t even transfer funds out through the app. All you can do is close your existing positions - and even then, only in "reduce-only" mode.That’s not a bug. It’s by design. After seven straight days in this "close-only" state, your account gets upgraded to "Blocked." Now you can’t view your trade history. You can’t access your subaccounts. The only thing left? Your Secret Recovery Phrase. That’s it. No UI. No buttons. Just a string of words you’d need to use elsewhere to recover your funds.

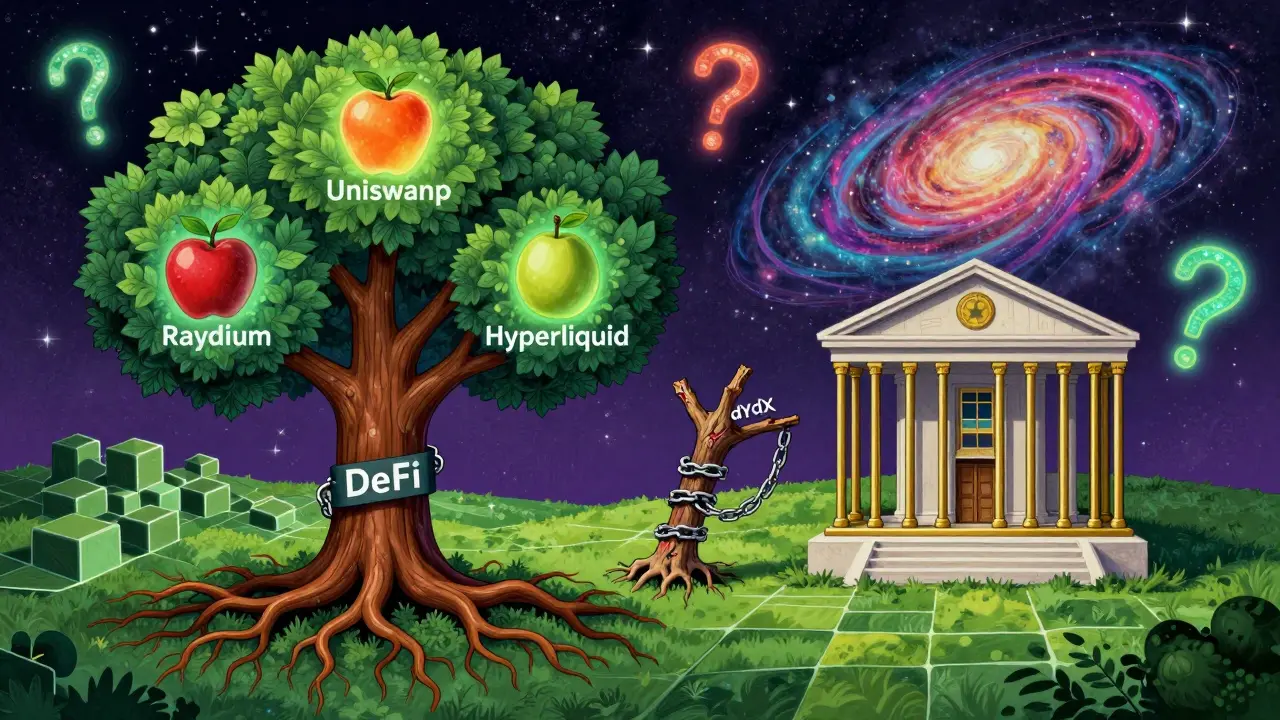

This isn’t how true decentralization works. If dYdX were fully decentralized, like Uniswap or PancakeSwap, there’d be no way to enforce these rules. No central server. No frontend company. No legal entity to pressure. But dYdX has all of those. It’s built on a blockchain, yes - but its user interface, customer support, and compliance team are run by dYdX Operations Services Ltd. a company registered in the UK that manages the frontend, user verification, and geographic restrictions. And behind that? dYdX Trading Inc. a New York-based entity that handles legal compliance, regulatory filings, and corporate governance. Then there’s the dYdX Foundation based in Zug, Switzerland, responsible for launching the DYDX token and overseeing protocol upgrades.

Who Gets Blocked - And Who Doesn’t

The list of banned countries is long. You can’t use dYdX if you live in the U.S., U.K., Canada, Iran, Cuba, North Korea, Syria, Myanmar, Crimea, Donetsk, or Luhansk. But here’s the twist: you can use it if you’re in China, Russia, South Korea, Japan, or Vietnam. That’s not random. It’s strategic.Why? Because dYdX isn’t trying to obey every rule. It’s trying to obey the right rules - the ones enforced by the U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC). The U.S. government has the most global reach when it comes to financial sanctions. So dYdX complies with OFAC’s list. If you’re on it, you’re blocked. If you’re not - even if your country has its own crypto bans - you’re still in.

That’s why you’ll find dYdX accessible in places like Nigeria, Indonesia, or Thailand - countries with heavy crypto regulations - while Americans get locked out. It’s not about safety. It’s about jurisdiction. dYdX operates legally in places where it can get licenses or avoid penalties. It doesn’t care about local laws unless they intersect with U.S. sanctions.

The Contradiction: Decentralized in Name, Centralized in Practice

The whole point of DeFi is to remove intermediaries. To let people trade directly, without asking permission. But dYdX’s restrictions prove it’s not truly decentralized. It’s a hybrid. The trading engine runs on-chain. The orders are settled by smart contracts. But the front door? Locked. Controlled. Monitored.Think of it like a bank that says, "We’re decentralized - you own your money - but we’re not letting you walk in unless you’re from a country we approve." That’s not decentralization. That’s regulation dressed up in blockchain.

Other platforms like Uniswap a decentralized exchange on Ethereum that allows anyone to trade tokens without KYC or geo-blocks. or Raydium a Solana-based DeFi protocol with no user restrictions. don’t block users by location. They don’t need to. They have no central team. No legal entity. No headquarters. If a user from a banned country trades on them, there’s no one to punish. No company to fine. No server to shut down.

dYdX chose a different path. It built a company. It hired lawyers. It signed compliance agreements. And in doing so, it gave regulators the power to control who can use it. That’s not a flaw. It’s the business model.

Why This Matters for the Future of Crypto

dYdX isn’t an outlier. It’s a preview. More DeFi projects are walking this tightrope. They want the freedom of blockchain. But they also want to attract institutional money. They want to partner with banks. They want to list on traditional exchanges. To do that, they need to play nice with regulators.That means geo-blocks. That means KYC. That means handing over user data when asked. And it means pretending to be decentralized while quietly operating like a bank.

The irony? The more dYdX tries to look compliant, the more it undermines the core promise of crypto: financial sovereignty. If you need permission to trade, it’s not decentralized. If a corporation can lock your account, it’s not permissionless.

This is the reality for many DeFi platforms today. They’re not rebels. They’re reformers. They’re trying to make crypto fit into the old system - not replace it.

What You Can Do If You’re Blocked

If you’re in a restricted country and you’re locked out of dYdX, you have a few options:- Withdraw your funds - If you’re still in close-only mode, use reduce-only orders to close positions and pull your assets out. Once they’re in your wallet, you can move them elsewhere.

- Use a non-restricted platform - Try Hyperliquid a decentralized derivatives exchange with fewer geo-restrictions than dYdX. or Bybit a centralized exchange that allows many restricted users with minimal KYC. - though they have their own rules.

- Learn the risks - Using a VPN to bypass restrictions violates dYdX’s terms. If caught, your account may be permanently blocked. Your funds aren’t lost - but your access is.

There’s no workaround that’s both safe and legal. dYdX’s restrictions aren’t going away. They’re part of the cost of doing business in crypto today.

What’s Next for dYdX?

dYdX currently supports 33 trading pairs, including Ethereum, Bitcoin, Solana, and Chainlink. It’s one of the most liquid decentralized derivatives platforms out there. But its growth is tied to its ability to stay in good standing with U.S. regulators.As global rules tighten - especially around stablecoins, leverage, and cross-border trading - dYdX will likely expand its list of restricted countries. The U.S. is pushing for stricter rules on DeFi. The EU is preparing MiCA regulations. Australia and Singapore are watching closely. dYdX won’t risk its legal status to serve users in Zimbabwe or Sudan.

The future of DeFi might not be fully decentralized. It might be regulated DeFi. Platforms that look decentralized on the surface - but are controlled behind the scenes. dYdX is already there. And it’s not alone.

Write a comment