Crypto Review: Honest Evaluations of Exchanges, Tokens, and Scams

When you read a crypto review, a detailed assessment of a cryptocurrency platform, token, or service meant to help users make informed decisions. Also known as crypto analysis, it’s not just a opinion—it’s a fact-checking tool in a market full of fake promises. Most people think crypto reviews are just hype or paid promotions. But the truth? Many are warnings in disguise. Take Amaterasu Finance: zero trading activity, a trust score of 2, and no users. That’s not a bad exchange—it’s a ghost. Or STAKE: a word you hear everywhere, but no actual token exists. People get tricked into buying something that’s just a process—staking—not a coin. These aren’t mistakes. They’re traps.

Good crypto exchange, a platform where users buy, sell, or trade cryptocurrencies, often with varying levels of security, fees, and regulation. Also known as cryptocurrency trading platform, it’s not just about low fees or flashy apps. It’s about survival. KuMEX works for experienced traders outside the U.S., but blocks Americans. StackSwap competes with Uniswap, but does it have real liquidity? Or is it just another empty shell like 4E, with no team, no history, and no transparency? And then there’s Nigeria: no outright ban anymore, but only licensed platforms like Quidax and Busha can handle Naira. If you’re trading there, you’re not avoiding rules—you’re navigating them. A crypto review that doesn’t mention regulation is missing half the story. Meanwhile, airdrops like MoMo KEY or SHO get flooded with fake websites. They promise free tokens, but the token has no trading volume, no community, and no official team. That’s not a giveaway—it’s a phishing lure. Even big names like CoinMarketCap get used in scams, like the ONUS airdrop, which was real—but only because it was tied to a verified partner. Most aren’t.

What you’ll find here isn’t fluff. It’s a collection of hard truths: exchanges that shut down, tokens that never launched, and regulations that changed overnight. You’ll see how BaFin in Germany, Jordan’s Central Bank, and Nigeria’s SEC are reshaping what’s legal. You’ll learn why carbon credit tokens, real estate tokens, and AI crypto projects sound exciting but need deep checking. You’ll spot red flags in trading bots like Aivora Trade that aren’t even exchanges. This isn’t a list of recommendations. It’s a survival guide. Every post here answers one question: Is this real, or is it rigged? And if it’s rigged, how do you walk away before you lose everything?

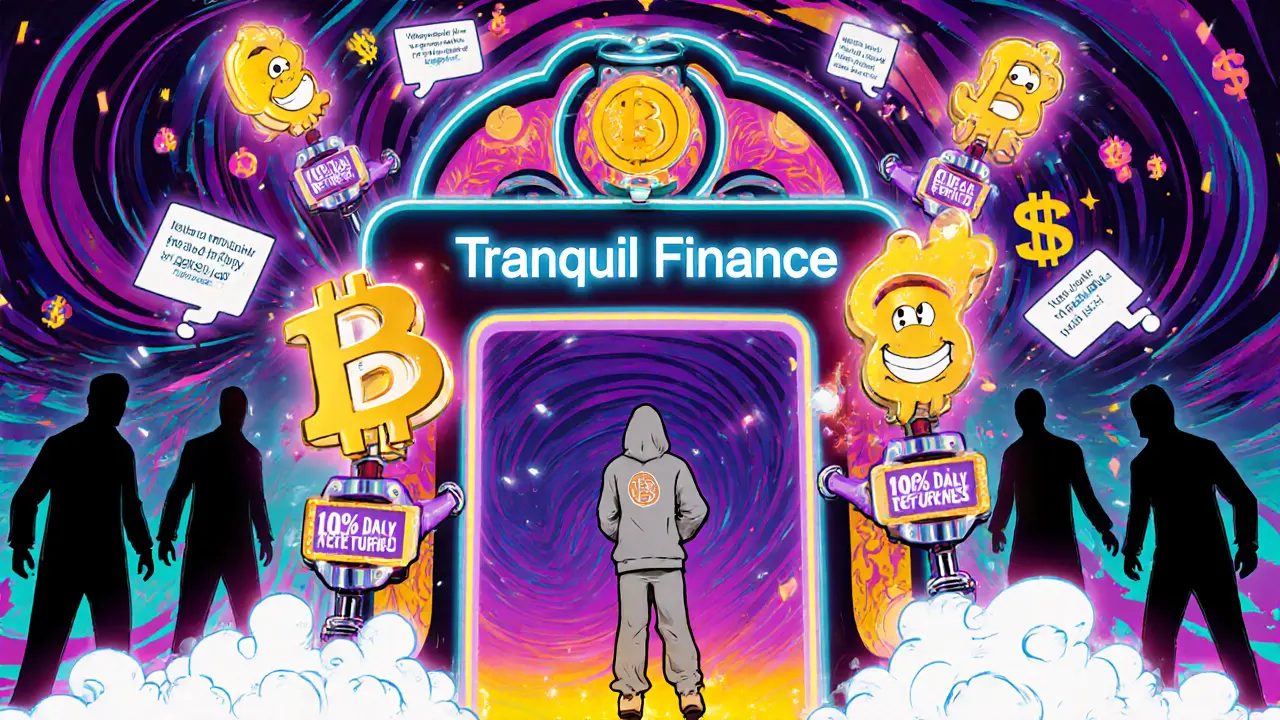

Tranquil Finance Crypto Exchange Review: Is It Legit or a Scam?

Tranquil Finance is not a legitimate crypto exchange. No credible reviews, audits, or user data exist for it. Learn why it's a scam and which real platforms to use instead in 2025.